Omnichannel retail: continuing challenges for anti-trust authorities

Omnichannel retail continues to challenge competition authorities' conventional approach to defining retail markets.

The studies of shopping behaviour during the COVID-19 pandemic show how readily consumers search and shop across many and varied channels.

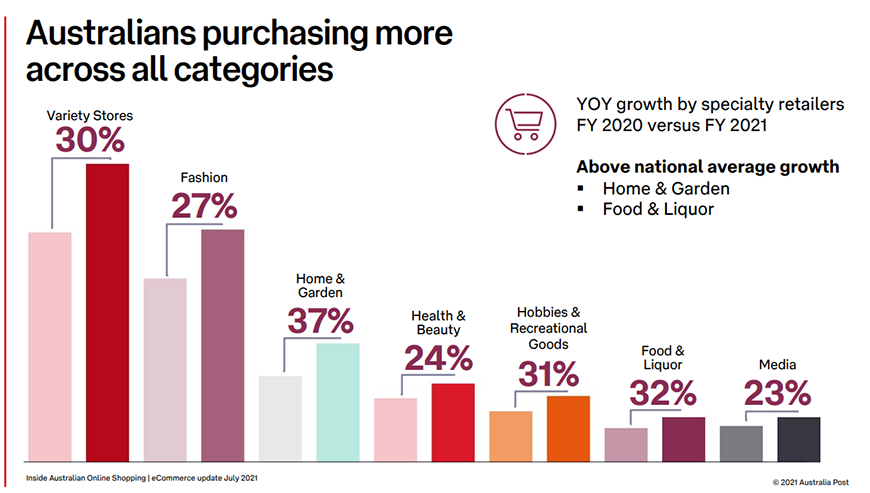

According to Australia Post's eCommerce reports into Australian online shopping, in FY2021, online shopping increased by 31.8% year-on-year, with 9.1 million households purchasing online. This is on top of the growth experienced in 2020, with Australian consumers spending a record $50.46 billion compared to $27.5 billion in 2018.

– Source: Australia Post eCommerce report

Antitrust authorities have considered competition between online and bricks and mortar channels in analysing competitive constraints in retail mergers for many years.

To take one illustrative example, in 2009, the parties to a proposed merger between two retail book stores (Angus & Robertson and Borders Australia Pty Limited) submitted to the ACCC that online and digital book sales were increasing and likely to become a strong competitive constraint on the operations of bricks and mortar stores. Notwithstanding the parties' submissions, the ACCC found that online and digital books sales were unlikely to become a close competitive constraint in the period following the merger. Ironically, since the merger, countless bricks and mortar book stores have closed and the predominant method of purchasing and consuming books today is through online bookstores and digital platforms offering e-books.

In a similar vein, in 2018 the UK Competition and Markets Authority (CMA) concluded that online grocery offerings were not a substitute for bricks and mortar stores or part of the same product market as those stores (Sainsbury/Asda (2018)). At that time, despite evidence of increased online grocery shopping by consumers, the CMA found that online grocery retailing was a separate market to in-store grocery retailing, because many customers who shopped online, did so for a specific purpose (eg. not being able to transport large, bulky items).

Other established antitrust jurisdictions have factored in online sales as substitutable for bricks and mortar sales. For example:

- In 2016, the French Competition Authority (FCA) defined a market including in-store and online retail channels in its decision regarding Fnac Group’s acquisition of Darty, a rival appliance, electronics, and entertainment products retailer. There, the FCA found that the increasing competitive pressure exerted by online sales was significant enough to be integrated in a single market.

- In 2020, the German Competition Authority (Bundeskartellamt) took account of online and mail order sales in considering the merger between two book retailers. The Bundeskartellamt noted that this was appropriate because in spite of the differences, brick and mortar sales and online sales are becoming increasingly substitutable as a result of:

- services such as overnight orders, home delivery and "click and collect" being offered by bricks and mortar stores; and

- online retailers attempting to match the advantages traditionally offered by bricks and mortar stores – eg. by offering customers free returns or a virtual "look inside" a book.

What antitrust authorities might do in the future

Antitrust authorities are likely to continue to be challenged to address the realities of omnichannel retail and consumer expectations of a seamless shopping experience and the studies of shopping behaviour during COVID confirm the wealth of available data. In terms of the ACCC's likely approach, consistent with its purposive approach to product market definition, it likely to continue to define markets on a case by case basis. But it does seem reasonably safe to predict that that the ACCC will be placed under increased pressure to give weight to the competitive constraints from this ever-increasing range of sources of competition when considering retail markets.

A postscript…

It is within this context that the ACCC is examining competition and consumer issues in general online retail marketplaces. The ACCC's interim report on general online retail marketplaces is due in March 2021. In that report, the ACCC has indicated that it will address the degree of competition between general online marketplaces and the extent to which competition from other sources – such as bricks and mortar retailers – constrains or affects their practices.

Get in touch