It’s time to determine the fate of the BNPL industry

Treasury has released an options paper and is seeking submissions to inform a Government decision on the regulatory framework for BNPL arrangements in Australia by 23 December 2022.

On 21 November 2022 Treasury released an options paper seeking feedback on the future regulatory framework for buy now, pay later (BNPL) arrangements, potentially including regulation under the National Consumer Credit Protection Act (Credit Act). Submissions made to Treasury by 23 December 2022 will inform a government decision on the framework.

The Government’s decision will have significant implications for the BNPL industry given the varying levels of regulatory intervention attaching to the options put forward for consideration.

What has been proposed for consideration?

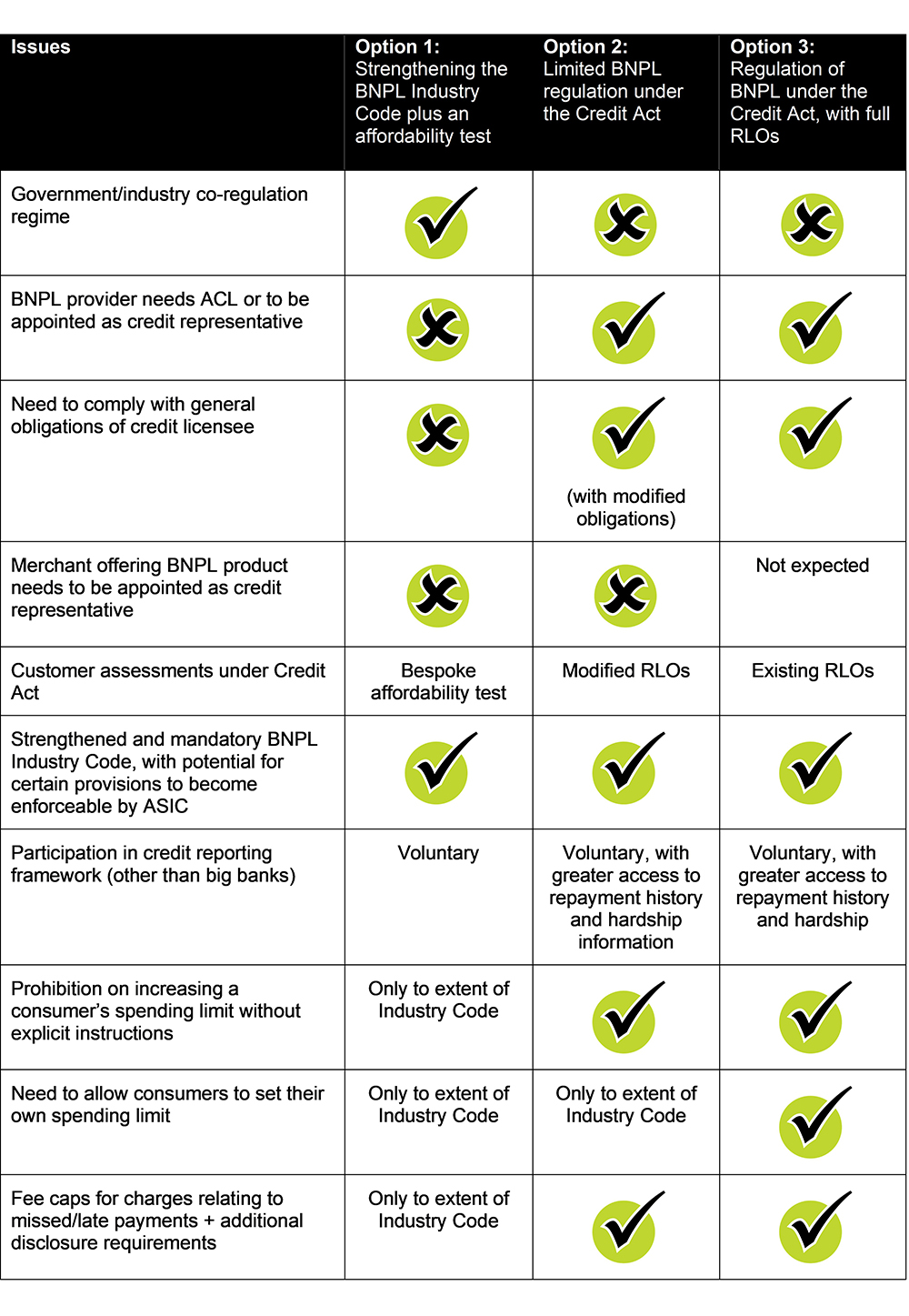

Treasury has proposed three options for consideration. What each of those options involves is summarised below:

How would the Government look to strengthen the BNPL Industry Code?

It is contemplated that the BNPL industry would work in consultation with government to strengthen the BNPL Industry Code by expanding on existing commitments to address further concerns relating to:

- product disclosure and warning disclosure requirements;

- access and standards of dispute resolution and hardship practices;

- excessive consumer fees and charges, including default fees;

- refund and chargeback processes;

- advertising and marketing;

- mitigating risks associated with scams, domestic violence, coercive control, and financial abuse; and

- ensuring adequate compliance with requirements.

What would the bespoke affordability test involve?

For Option 1, Treasury say that it is intended that the bespoke affordability test under the Credit Act would provide for the scalable and efficient checking of a consumer’s ability to afford the BNPL credit related to the overall value of the credit being provided.

An example is given that, when lending below certain thresholds, a credit score check could be used as a proxy of a consumer’s credit risk, and income and expenses information would only need to be considered against a risk assessment where a person is identified as a risky borrower.

There would be no requirements to verify a customer’s financial situation or check if the provision of credit aligns with a person’s needs and objectives.

What would the modified responsible lending obligations look like?

Under Option 2 BNPL providers would be required to assess that the BNPL credit is not unsuitable for a person, similar to the existing responsible lending framework but scaled to the level of risk of the BNPL product or service. Treasury says this may include removing some prescriptive requirements, such as verifying a person’s financial documentation and checking that the BNPL credit aligns with the person’s needs and objectives.

Supplementary reforms

The paper also references a number of supplementary reforms, including noting that:

- an enhanced role for ASIC as regulator of BNPL may warrant a corresponding extension of ASIC funding arrangements to the BNPL sector; and

- the Reserve Bank has suggested changes to no-surcharge rules could improve competition and efficiency in the consumer credit market.

What you need to do

Treasury has asked for feedback on the three options presented and other factors that should inform the development of a BNPL regulatory framework. If you want to have your say, you will need make a submission by 23 December 2022.

Get in touch