The resurgence of enterprise bargaining 03: what to expect when you're expecting to bargain

Once bargaining has begun, there are strict legal obligations and practical steps employers should understand to ensure the negotiation goes as well as possible and avoid ending up before the Fair Work Commission.

So you've prepared your table of issues, decided key roles and responsibilities and engaged with your key stakeholders and you're ready to bargain (as we suggested in article 2!)? It's now time to sit down at the table and begin actively negotiating. But what does this look like? While negotiating, employers and employee representatives are bound by the rules of good faith bargaining, and need to ensure they are maintaining compliance with their current industrial instrument. Being familiar with these obligations will help keep employers out of hot water and ensure that bargaining stays focused on the substantive issues.

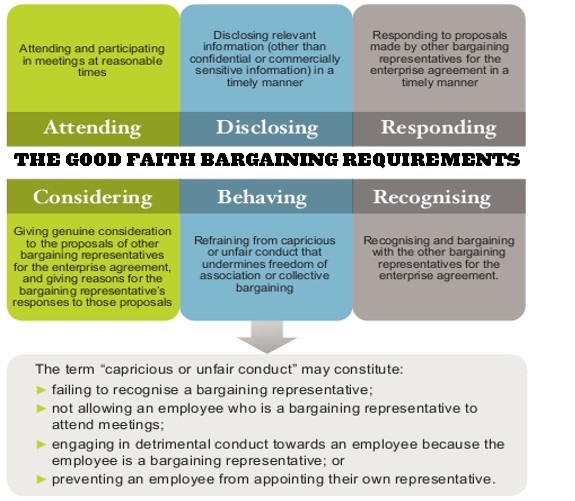

The GFBs, or the Good Faith Bargaining requirements

It is common for parties negotiating a new agreement to get stuck. Unfortunately, bargaining is often viewed as an adversarial process and parties will seek to delay, avoid or obfuscate the process in the hopes of getting their preferred outcome or avoid having an agreement altogether.

Your minimum obligations for how to conduct yourself during bargaining are set out in the Fair Work Act 2009 (Cth). The key rules are the good faith bargaining requirements (the GFBs), which are contained in section 228 of the Fair Work Act and summarised below:

Examples of conduct that has breached the GFBs includes:

- an employer refusing to make any substantive contribution to a proposed agreement, including not putting forward any of their own proposals or responding meaningfully to Union proposals; and

- proceeding to put a proposed new agreement to an employee vote despite knowing that some employees had a new bargaining representative and had made a new, separate log of claims which had not been responded to.

A key point to understand about the GFBs is that there is no obligation for parties to agree on a proposal. The GFBs only requires parties to genuinely consider and respond meaningfully and in a timely fashion to proposals. Employers are also not required to disclose commercially sensitive information, including their detailed costings of employee proposals (though it can be helpful to do so if an employer is refusing a proposal on financial grounds and disclosing the information would not be damaging to the business).

To help employers reduce the risk of breaching the GFBs, we recommend:

- employers keep a good faith bargaining log. This can be as simple as a table that records each claim made by employee representatives, the date the claim is made, and the date the employer responds;

- at the first bargaining meeting, all parties should agree a code of conduct for how negotiations will be conducted. This includes agreeing up front whether an employee who is acting as a bargaining representative is covered by any organisational code of conduct while they are performing their role as a bargaining representative; and

- timetable bargaining meetings, and the topics which will be discussed at each, at the beginning of the bargaining process. This ensures you know when to attend meetings and can come to meetings prepared to engage in the issues for discussion.

Failing to comply with the GFBs is serious. If the FWC is satisfied a party has failed to comply with the GFBs, they can issue a bargaining order under section 230 of the Fair Work Act compelling the recalcitrant party to bargain in good faith. Breaching a bargaining order is a civil penalty matter (section 233).

A bargaining representative can also apply to the FWC to deal with a bargaining dispute under section 240. This can happen even if there has been no breach of the GFBs, and can result in the FWC mediating the dispute and potentially, under the new changes to the Fair Work Act, making an intractable bargaining declaration.

The times, they are a'changin: keeping up to date with your existing industrial obligations

An issue which often arises is how to manage an employer's obligations to employees under any existing industrial instrument or enterprise agreement while negotiating for a new enterprise agreement.

An existing enterprise agreement will continue to operate until it is replaced by a new enterprise agreement. This means that even if your organisation's existing enterprise agreement has passed its nominal expiry date and you are actively negotiating a replacement agreement, the old agreement will continue to apply to the employees it covers.

Where things can get trickier is where an enterprise agreement has fallen out of step with any Modern Award which would apply to employees who are otherwise covered by an enterprise agreement. When an enterprise agreement is in operation and applies to relevant employees, it completely replaces the relevant Modern Award applying to those employees. However, the Fair Work Act includes a baseline protection for employees, requiring that the base rate of pay under an enterprise agreement cannot be lower than the base rate of pay under a relevant modern award (section 206(1)). If Modern Award rates increase above enterprise agreement rates, employers will need to ensure that employees receive the higher rate, regardless of whether or not they are in the process of negotiating a new enterprise agreement.

This issue is pressing for many employers in light of the FWC's recent announcement of a 5.75% pay rise. Many enterprise agreements which included pay rises of 2-3% p.a now risk falling out of step with the base rates of pay of their underpinning Modern Awards. The Australian Public Service Commission has recently issued a Circular to the Australian Public Service reminding them of the importance of reviewing base rates of pay, and non-government employers should also take the opportunity to review their base rates of pay.

If you identify that your base rates of pay have fallen below those in the applicable Modern Award, employers should ensure they increase pay rates. In the Commonwealth public service, this may require issuing a new Determination under section 24(1) of the Public Service Act 1999 (Cth). For non-public service employees, no formal documentation will need to be entered into, but you should nonetheless inform all employees of the change to their base rate of pay and the reasons for the change.

Key takeaway

Ensuring you meet your obligations during bargaining is critical to ensuring bargaining stays on track and parties can negotiate a new agreement as efficiently (and painlessly!) as possible. Employers should make sure they are complying with the GFBs and monitoring their ongoing compliance with their current industrial instrument throughout bargaining to avoid ending up before the FWC.

Get in touch