ASIC and APRA release FAR information package

In preparation for the roll-out of FAR, APRA and ASIC have released a suite of helpful resources to assist entities in preparing for compliance with the new regime.

On 3 October 2023, APRA and ASIC jointly published a comprehensive information package designed to support the financial services industry in implementing the Financial Accountability Regime (FAR) and provide insight into how the Regulators will administer the new regime.

The information package published by the Regulators includes:

- the Joint Administration Agreement for FAR agreed between APRA and ASIC;

- an Information Paper to assist ADIs and their Non-Operating Holding Companies (NOHCs) in transitioning from the Banking Executive Accountability Regime (BEAR) to FAR;

- a template and guidance document for ADIs to use when completing Accountability Statements for Accountable Persons; and

- an Implementation Timeline for FAR.

Joint Administration Agreement – how will FAR be administered?

The introduction of ASIC as a co-Regulator is one of the key differences between BEAR and FAR. The Joint Administration Agreement clarifies how the Regulators intend to administer FAR jointly, and sets out the principles underpinning their co-operation.

APRA and ASIC intend to maintain discrete regulatory mandates and clearly defined areas of responsibility under FAR while leveraging each other's existing capabilities and infrastructure:

- ASIC will focus on impacts to market integrity and consumer protection in the financial system and payments system; and

- APRA will focus on impacts to the prudential soundness of regulated entities as well as the financial stability of the overall system.

However, the Regulators will collaborate and co-ordinate regulatory activities "where there is joint interest on a FAR-related risk area." While either ASIC or APRA may lead certain regulatory activities independently, the Regulators intend to take a "co-ordinated approach" where a particular matter traverses the mandates of both organisations. To this end, the Agreement notes that the Regulators will be required to agree with each other before exercising certain powers under FAR.

Accountable Entities will report to both of the Regulators through the APRA Connect Portal including:

- registrations of Accountable Persons;

- lodgements of Accountability Maps and Accountability Statements; and

- other notifications, such as breach reporting.

Certain information provided to APRA or ASIC must be shared between the Regulators, including Accountability Statements and Accountability Maps, information accompanying a registration application, notices lodged by Accountable Entities and other information prescribed by the Minister Rules. In addition, FAR also permits the Regulators to share information for the purpose of the receiving Regulator performing its functions or exercising its powers. This may include, for example, information collected by either ASIC or APRA for the purposes of an investigation. The Regulators are not required to notify the party from whom the information was collected that the information will be shared. APRA and ASIC are also permitted to make certain information from the FAR register publicly available. The Regulators intend to publicly disclose any disqualifications of Accountable Persons to facilitate industry governance of Accountable Persons.

RG 278 – Information for ADIs transitioning from BEAR to FAR

Information Paper RG 278 will assist ADIs who were previously subject to BEAR to transition to FAR.

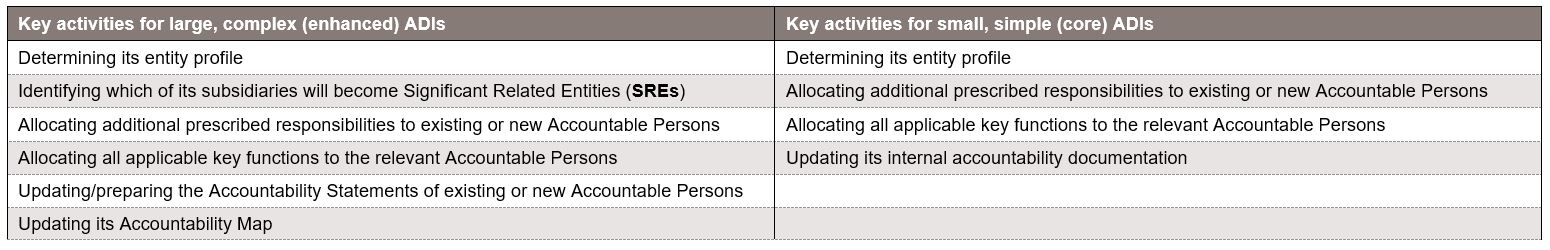

Ongoing compliance with BEAR is required until FAR commences in March 2024. In addition, as the BEAR and FAR obligations are not identical, RG 278 provides a list of Key Activities which Large ADIs and Small ADIs ought to engage in to prepare for FAR:

RG 278 outlines that in transitioning from BEAR to FAR, ADIs must take the following steps:

- Determine their Entity profile: determine whether they are an "enhanced" or "core" entity, and whether they will be subject to the enhanced notification obligations under FAR. Under the Draft Minister Rules, an entity will be an enhanced ADI if its asset size is greater than $10 billion.

- Provide additional information about existing Accountable Persons: ADIs will not be required to re-register Accountable Persons already registered under BEAR with the new FAR register. However, ADIs must provide additional information about their existing Accountable Persons, including the "key functions" for each Accountable Person.

- Apply for registration for new Accountable Persons: ADIs must ensure they apply for registration for any Accountable Persons who were not previously captured under BEAR, including those Accountable Persons within SREs and any personnel with prescribed responsibilities under the new Minister Rules.

- Update Accountability Maps and Statements: ADIs who meet the definition of "enhanced entities" must update their Accountability Maps and Accountability Statements to comply with the expanded scope of the FAR.

- Put in place processes and procedures to ensure they comply with their Notification Obligations

- Determine the impact of FAR on any entities or SREs within their corporate group: ADIs must take steps to identify whether any entities within their corporate group will meet the definition of an SRE under FAR.

- Maintain compliance with the Deferred Remuneration Obligations under BEAR for six months after the commencement of FAR, as well as comply with other transitional arrangements: Other obligations under BEAR which Accountable Entities must continue to comply with include following directions from the Regulators, and compliance with any enforceable undertakings or injunctions already in place.

You can read more about steps you can take to manage the transition from BEAR to FAR here.

Implementation timeline – what's next

The Implementation timeline provides for the roll-out of FAR as follows:

- October 2023: Joint Administration Agreement and ADI Information Paper published.

- Q4 2023: Final Regulator and Transitional Rules released, and Reporting form instructions.

- Q1 2024: FAR information paper and consultation on key functions for insurance and superannuation.

- March 2024: FAR commences for Banking.

- Q2 2024: Final Regulator rules for Insurance and Superannuation.

- March 2025: FAR commences for Insurance and Superannuation.

From October 2023, ASIC and APRA will begin hosting ADI and industry briefing sessions. The Regulators expect that ADIs participate in pre-commencement activities from this date in order to make the transition from BEAR to FAR as smooth as possible.

It is clear that the Regulators are not wasting any time in laying the foundations for the implementation of the FAR and that they expect entities to do the same.

Our team at Clayton Utz can assist your organisation in preparing for FAR. Contact one of our experts if you'd like to learn more about what FAR means for you, and what you can do to prepare.

Get in touch