JORC Code Review proposes enhanced transparency and ESG focus

The revised JORC Code, which will soon be open for consultation, will have greater qualitative considerations and alignment with global standards.

In late 2022, the Joint Ore Reserves Committee (JORC) provided a much-anticipated update to stakeholders regarding the progress of its review of the JORC Code. This review, the first in 11 years, has garnered significant attention due to its potential impact on Australia's mineral and exploration industry.

The Corporations Act requires representations and statements made to the market by Boards to have a reasonable basis. To meet this obligation, board members need to ensure that they have conducted thorough research and comprehensive analysis to support their claims. In the context of mineral resources, the JORC Code sets the framework and standard for evaluating technical information. Adhering to a recognised standard also allows an effective comparison by boards, investors and shareholders with the mineral results of other companies.

Furthermore, ASX Listing Rule 5.6 requires public reports released by mining companies to be prepared in accordance with the JORC Code. The principles governing the JORC Code, outlined in Clauses 4 and 9, are transparency, materiality, and competence. A public report prepared under it is expected to disclose all material information that an investor and their advisers would reasonably expect to make an informed decision. Given the technical level required in relation to the report on mineral exploration or resources, the JORC Code requires the information in it to be prepared, verified and approved by a qualified person affiliated with professional bodies like the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) with sufficient relevant experience in the type of mineral resources they are reporting on.

Initially scheduled for a Q1 2023 public review, the draft Code was expected to undergo a 90-day period of public comment and feedback. However, a delay in the completion of the review by the Australian Securities Exchange (ASX) and the Australian Securities and Investments Commission (ASIC) has pushed back the public review period. This delay is intended to allow time for the committee to assess comments and input both from the ASX and ASIC.

The proposed update to the JORC Code is substantive, encompassing various new clauses that address Competent Persons, reasonable prospects, risk, reconciliation, and environmental, social, and governance (ESG) considerations. In addition, the draft Code introduces a changed structure, separating Code and guidelines and incorporating table 1 format changes. These changes prompted a detailed review to understand their potential impact on listing rules and compliance under the Corporations Act.

JORC review highlights key concerns

A broad spectrum of exploration and mining project activities has been assessed throughout the review process. The scrutiny of IPO documents and exploration reports to feasibility studies and production announcements, has revealed several areas of concern that may require amendment. These areas include:

- Competent Person: Instances where companies failed to nominate a Competent Person or the use of professionals who lacked the adequate eligibility criteria to be a Competent Person. A Competent Person within the definition in JORC must entail membership with AIG or AusIMM, or recognition by a reputable overseas professional organisation;

- Industrial Minerals Characterisation: Notable gaps were identified in resource announcements, particularly in describing the physical characteristics of industrial minerals. Precise and comprehensive characterisation remains important for transparent reporting;

- Metal Reporting Integrity: Reporting containing metal values without corresponding details on tonnes and grade which may hinder accurate assessment and understanding by investors;

- Metal Equivalent Values Clarification: Reporting of metal equivalent values without explaining the methodology used for equivalence estimation raises concerns over clarity and comparability; and

- Feasibility Study Disclosure: Certain feasibility study announcements, combined with resource information, metallurgical process specifics, and project economics, have lacked a description of the intended resource extraction approach. This omission does not allow an understanding of project viability.

Striking a balance: evolving the "modifying factors" section

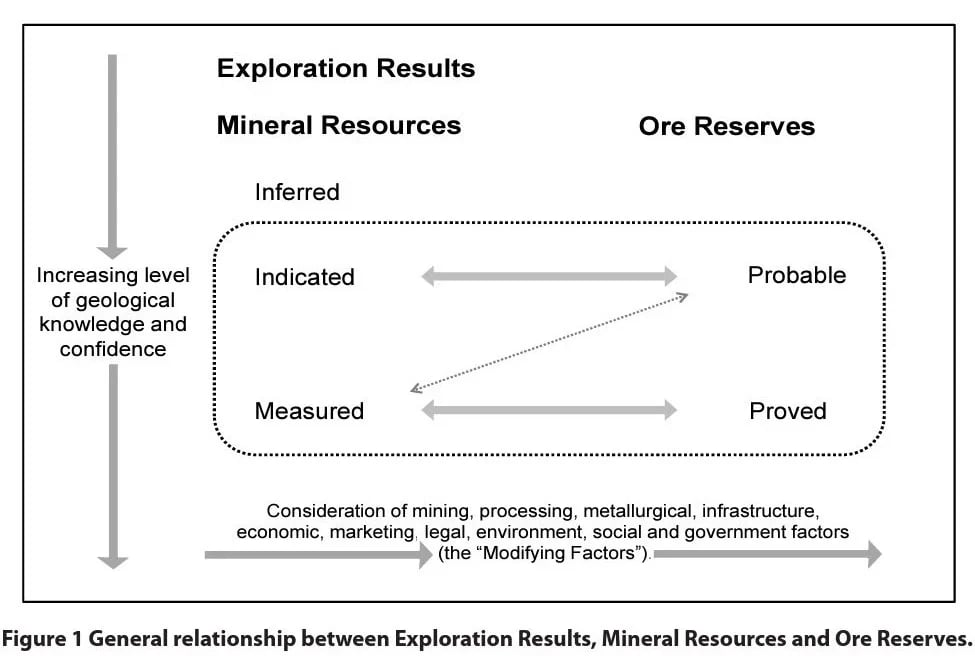

While the JORC Code traditionally places emphasis on geoscience aspects, its existing iteration also stresses the significance of qualitative considerations. These considerations encompass factors like government approvals and community support for mineral extraction, as outlined in the "modifying factors" section of the code. In the ongoing review, this particular section is experiencing substantial transformation, with the enhancement of environmental, social, and governance (ESG) disclosure requisites, and given the emergence of ESG in recent times, it is an apt consideration, ie., the modifying factors.

The Code refers to the "Modifying Factors" as considerations used to convert mineral resources to ore reserves. Figure 1 (see below) in the Code demonstrates the general relationship between Exploration Results, Mineral Resources and Ore Reserves.

JORC also aims to align with global regulatory requirements or guidance through engagement with peer jurisdictions and organisations for eg. Canada, South Africa, or CRIRSCO. The approach to the review places emphasis on ensuring that mining and exploration companies provide investors with a comprehensive understanding of both qualitative elements that could impact mineral extraction profitability and the quantitative composition of the deposit. The approach shows a proactive stance towards transparency and sustainability, reflecting a move with the time for robust reporting standards that take into account diverse dimensions of mineral exploration.

Given the role of ASX and ASIC in relation to the review and consideration of public reports in disclosure documents, it is important to get their feedback prior to public consultation. However, the initial draft also included responses from surveys and recommendations from subject matter experts and working groups.

A definite timeline has yet to be provided for public consultation, and the public review period is expected to be for a period of 90 days, after which a second draft will be circulated.