Launch of TNFD global framework is a step towards a nature-positive future

The Taskforce on Nature-related Financial Disclosures' new global framework is for organisations to report and act on evolving nature-related dependencies, impacts, risks and opportunities, after two years of development and market consultation.

The Taskforce on Nature-related Financial Disclosures (TNFD) arose from an urgent need to recognise that nature underpins the global economy and that our economies are embedded within nature, not external to it. The world’s central banks have made it clear that biodiversity loss is a growing and serious source of systemic risk alongside climate change.

The TNFD recommendations are a ground-breaking global framework based on the climate related disclosure framework (TCFD), which aligns with international reporting standards such as the International Sustainability Standards Board's (ISSB) IFRS-S1 and the Global Reporting Initiative's (GRI) requirements and will allow integrated nature and climate reporting.

Previous versions of TNFD have been pilot tested by 200 institutions across different sectors and biomes ranging from global multinational corporates to financial institutions to Indigenous-led enterprises.

Its purpose is to establish a foundation for consistent and comparable assessment and reporting on nature by businesses worldwide. TNFD co-chair David Craig commented that businesses are "inadequately accounting for nature-related dependencies, impacts, risks and opportunities. Nature-risk is sitting in company cash flows and capital portfolios today. The costs of inaction are mounting quickly".

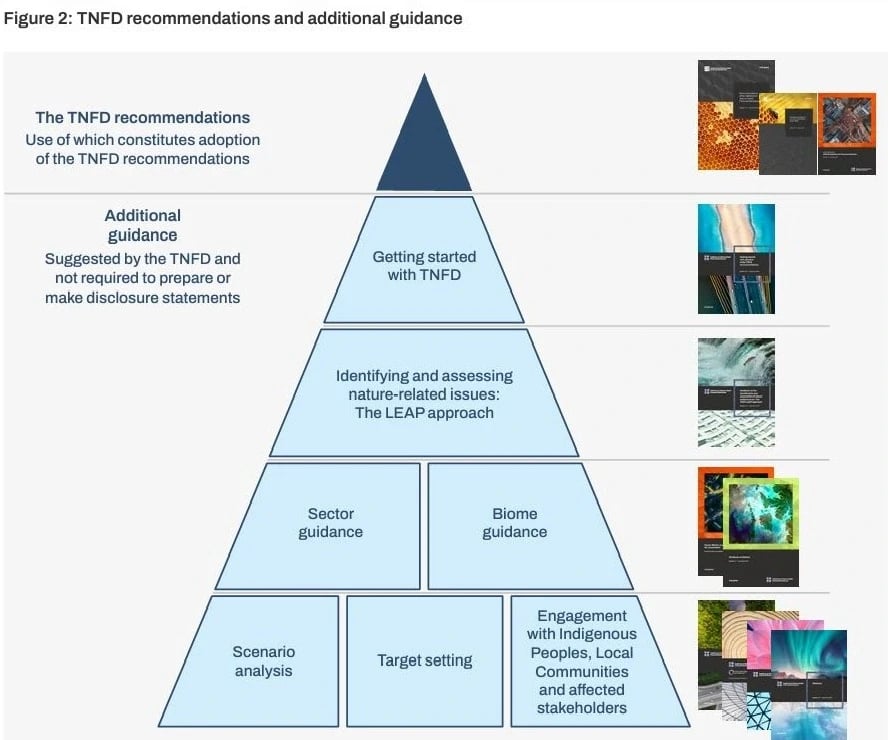

In addition to the TNFD recommendations, the Taskforce has published a range of additional guidance to help companies with the daunting task of assessing and reporting their nature impacts.

The LEAP Approach

A cornerstone of TNFD is an integrated approach for the assessment of nature-related issues designed for use by organisations of all sizes and across all sectors and geographies called the LEAP approach which involves four phases:

Locate your interface with nature;

Evaluate your dependencies and impacts on nature;

Assess your nature-related risks and opportunities; and

Prepare to respond to, and report on, material nature-related issues, aligned with the TNFD’s recommended disclosures.

The TNFD recommended disclosures

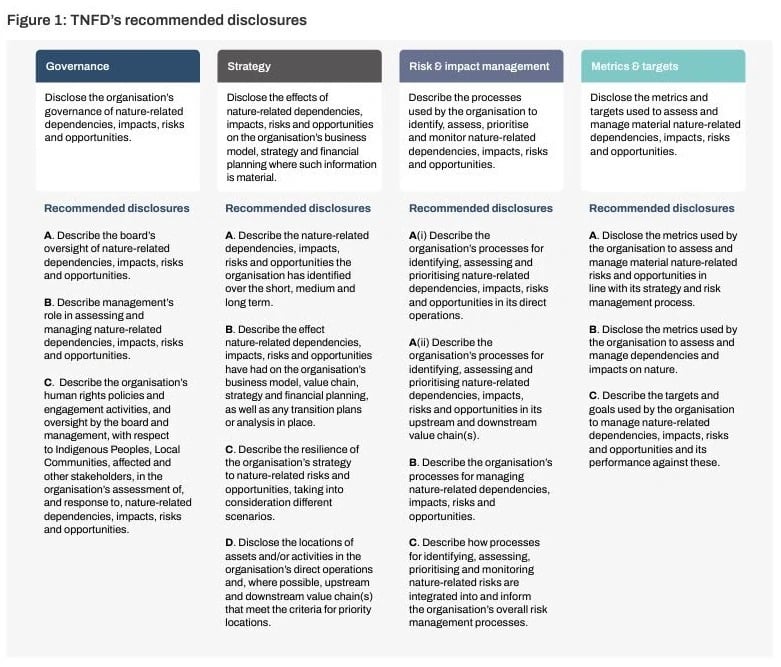

The TNFD has designed its recommended disclosures to meet the corporate reporting requirements for different organisations across jurisdictions and ensure consistency with "the global baseline for corporate sustainability reporting". The framework consists of:

- conceptual foundations for nature-related disclosures,

- a set of general requirements covering materiality, scope of disclosures, location, integration with other sustainability-related disclosures, time horizons and engagement (see below); and

- a set of recommended disclosures structured around TCFD's four pillars of governance, strategy, risk and impact management, and metrics and targets (see Figure below).

The Governance role of the board for TNFD is particularly important at a time where skills and competencies are being reassessed in light of the huge increase in environment and social risk issues that boards are grappling with.

New nature-specific disclosures

In addition to requiring the disclosures against the TCFD framework, the TNFD has introduced three new recommended disclosure requirements, focused specifically on the challenges of nature:

1. Engagement disclosure: Describe the organisation's human rights policies and engagement activities, and oversight by the board and management, with respect to Indigenous Peoples, Local Communities, affected and other stakeholders, in the organisation's assessment of, and response to, nature-related dependencies, impacts, risks and opportunities.

According to the TNFD recommendations, Indigenous Peoples are stewards of 80% of the world’s remaining biodiversity and a source of traditional knowledge about the planet’s ecosystems, giving them a uniquely important role in halting and reversing nature loss. Their knowledge, including traditional knowledge and experience, can also be a valuable input into an organisation’s identification, evaluation, assessment and management of its nature-related dependencies, impacts, risks and opportunities. The company should describe its process for engaging Indigenous Peoples, Local Communities and affected stakeholders about their concerns and priorities with respect to nature-related dependencies, impacts, risks and opportunities in its direct operations and value chain.

2. Priority locations disclosure: Disclose the locations of assets and/or activities in the organisation's direct operations and, where possible, upstream and downstream value chain(s) that meet the criteria for priority locations.

Consideration of the geographic location of the company’s interface with nature should be integral to the assessment of nature-related issues, recognising that dependencies and impacts on nature occur in specific ecosystems. In some cases, nature-related issues will cover multiple ecosystems and locations, as both nature and impact drivers are mobile, for example, in the case of migratory species or the spreading of pollutants. Criteria for particularly sensitive biodiversity locations include:

- areas of high ecosystem integrity

- areas of rapid decline in ecosystem integrity

- areas of high physical water risks, and

- areas of importance for ecosystem services including benefits to indigenous peoples, local communities and stakeholders.

3. Value chains disclosure: Describe the organisation's processes for identifying, assessing and prioritising nature-related dependencies, impacts, risks and opportunities in its upstream and downstream value chain(s).

This disclosure builds from the TCFD requiring organisations to report against scope 3 emissions across their value chain. The TNFD recommendations have split the nature reporting into upstream and downstream value chains. For financial institutions and large consumer goods companies, for example, most of their potentially material nature-related issues will be upstream and downstream and not in their direct operations. There are additional complications for financial institutions when assessing value chain impacts, particularly those deploying capital across highly diversified portfolios and/or on a thematic basis (such as an index fund). The Taskforce recognises that value chain assessment and disclosure is complex and may take some time given data and capacity limitations. As such they have released a discussion paper with draft guidance for organisations on how to approach the analysis of their value chains, where it is appropriate to seek full traceability, and where use of secondary data may be an acceptable alternative to the direct measurement of dependencies and impacts.

Assessing materiality

The TNFD recommendations expressly do not prescribe a materiality threshold that companies should apply. In part this is because different materiality thresholds are used for different corporate reporting standards and regulatory requirements in different jurisdictions focused on either:

- overall "financial materiality" to the company or

- "impact materiality" reflecting the effect the company has on people and the environment.

The TNFD recommends that report preparers should provide information that meets the material information needs of:

- capital providers as a baseline consistent with the ISSB's IRFS Standards' and the TCFD recommendations, with a focus on risk management and how dependencies and impacts on nature create risks and opportunities for an organisation's financial position and prospects; and

- stakeholders aligned with a broader materiality approach, reporting against both the ISSB global sustainability reporting baseline and the impact materiality approach of GRI standards if they choose or need to do so.

The future use of the TNFD recommendations

It is likely that there will be a rapid uptake of the TNFD recommendations, as some corporations have already indicated their willingness to use the TNFD recommendations in their reporting. The TNFD surveyed its members, receiving responses from approximately 250 companies and financial institutions across 11 sectors, with organisations headquartered in over 25 countries. Over 70% of respondents advised that they are planning to report against the recommendations in FY24.

The TNFD has recognised that every organisation is different, and each organisation will have its own pathway to adopting the TNFD recommendations. Regardless, if TNFD has even a fraction of the impact that TCFD has had globally on disclosures and, consequently, investment, there are prospects that significant amounts of private capital will be funnelled into nature-positive projects.

TNFD will be a vital foundation upon which a high-integrity nature credit market can grow in Australia.

Get in touch