Two taxpayer wins against the ATO in Federal Court GAAR cases – Minerva and Mylan

In the space of March, the ATO had two losses in the Federal Court, with judgments being handed down in quick succession in Minerva Financial Group Pty Ltd v Commissioner of Taxation [2024] FCAFC 28 (8 March 2024) and Mylan Australia Holding Pty Ltd v Commissioner of Taxation (No 2) [2024] FCA 253 (20 March 2024).

The decisions are particularly relevant to organisations which are considering whether the general anti-avoidance rule (GAAR) in Part IVA might apply to their arrangements, either historically or prospectively. The decisions concern the potential for the GAAR to apply in scenarios which frequently need to be considered by large organisations – the use of trusts and financing decisions.

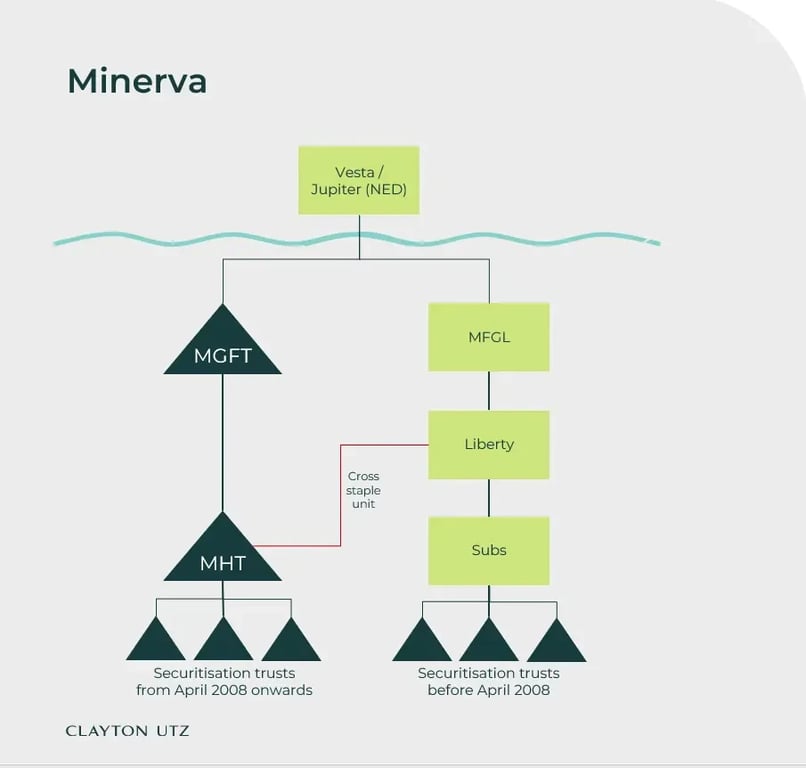

Minerva

In Minerva, the Liberty Finance group established a stapled structure in 2007 ahead of a potential IPO. The group's assets were separated between a company side and a trust side, with the same foreign ownership in the Netherlands before and after the restructure. The trusts were flow-through for tax purposes, meaning improved tax outcomes were obtained from funds flowing through the trust side to investors compared to the prior structure in which the company side was taxable at 30%.

However, despite the IPO not proceeding, the Full Court (Besanko, Colvin and Hespe JJ) concluded that the structure was established with the IPO in mind, and not for the dominant purpose of reducing Australian tax. Minerva had obtained commercial advice that a staple would be commercially preferable for any IPO, and it led expert evidence about why this was the case.

Minerva lost at first instance, where the Federal Court focussed on the improved tax outcome which resulted from the stapled structure. On appeal, the Full Federal Court gave greater weight to the commercial objective of the group in arranging its structure to best attempt an IPO. Despite the group ultimately not having its IPO until 2020, its repeated attempts over time helped to persuade the Court that the dominant purpose for its structure was commercial reasons (not tax reasons).

We understand that the ATO has not sought special leave to appeal the decision to the High Court.

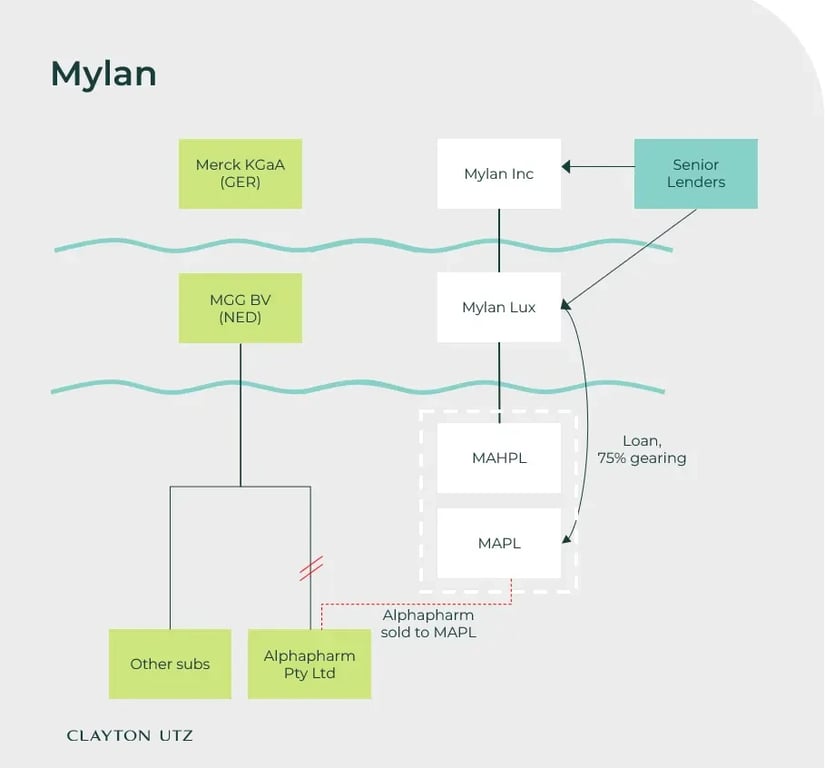

Mylan

In Mylan, the ATO challenged a debt push down to an Australian entity in connection with Mylan's acquisition of the Alphapharm business. The ATO sought to deny interest deductions based on the amount of Australian debt, the interest rate on the loan or both.

Justice Button held that although some additional tax deductions were obtained, the arrangement was not entered into for the dominant purpose of reducing Australian tax. Her Honour found a preferred counterfactual, which included some elements contended for by the ATO, some by the taxpayer, and some where Her Honour landed in between the parties' positions. The preferred counterfactual resulted in tax benefits for Mylan, which had claimed higher interest deductions than would have resulted under this alternative.

Turning to the dominant purpose analysis, Justice Button concluded that there was only one factor which favoured the ATO's position. This was Mylan's failure to refinance the debt after the GFC occurred, despite being able to repay the intragroup loan at any time. Her Honour reasoned that an independent borrower would be expected to have done so given the steep fall in interest rates during the GFC.

However, this was only one factor in the purpose analysis. The remaining factors, most notably including the manner in which the scheme was entered into and the form and substance of the scheme, were found to not indicate a tax avoidance purpose. Accordingly, Part IVA was concluded to not apply.

The case had received significant attention on account of the ATO initially arguing that either the GAAR or the transfer pricing law applied. However, the ATO dropped its transfer pricing arguments prior to the hearing, relying only on the GAAR (ultimately unsuccessfully). In that context, the finding of Justice Button that Mylan's Australian subsidiary might have been expected to refinance its debt and take advantage of lower interest rates post-GFC is very interesting. This might have established a transfer pricing adjustment, which in contrast to the GAAR does not require the ATO to show that the arrangement was entered into for a tax avoidance purpose. Given how the case was argued, we will never know what the outcome would have been.

The ATO has not appealed the decision to the Full Federal Court.

More detailed analysis?

If you would like a copy of our more comprehensive analysis of the decisions with our recommendations for how MNEs might consider thinking about these issues, or to have a complementary discussion about how the decisions are relevant to your organisation, please contact us.