Foreign investment into Australia FYE 30 June 2024: trends and implications

The United States of America has dominated direct foreign investment into Australia for FY22, FY23 and FY24.

Processing times remain an issue for foreign investors, although there are marked differences depending on the nature of the investment, according to the Federal Treasury’s latest set of data.

The latest data on foreign investment in Australia have been released, tracking the investment in the last two quarters of FY24 and agricultural land and water entitlement ownership as at 30 June 2023.

On 5 November 2024, the Federal Treasury released four reports relating to foreign investment in Australia:

- Q3 Quarterly Report on Foreign Investment (1 January to 31 March 2024);

- Q4 Quarterly Report on Foreign Investment (1 April to 30 June 2024);

- Register of foreign ownership of agricultural land as at 30 June 2023; and

- Register of foreign ownership of water entitlements as at 30 June 2023.

Looking across the FIRB data for FY24:

- the United States continues to dominate direct investment (by value and number) into Australia, followed (by value) by Japan, France, Singapore, Germany and Canada – largely mirroring previously tracked periods with the exception of France and Germany who have entered into the top six foreign investor countries based on strong investing in Q3 and Q4 of FY24;

- the industry sectors which have attracted the most direct investment (by value), equally, are the mineral exploration & development and services, with daylight third. The industries attracting the next most direct investment (by value) include the commercial real estate and finance & insurance sectors;

- median processing times for commercial investment proposals remain somewhat stagnant, and above the statutory 30-day timeframe for making a decision – FY22: 52 days; FY23: 41 days; FY24: 42 days. However, the median processing times for residential real estate investment proposals are much less – FY22: 5 days; FY23: 4 days; FY24: 6 days.

Australia's top investors – FYE 30 June 2024

The full FYE 30 June 2024 figures (by value) show the United States ($65.7 bn) remained well on top of foreign countries that make direct foreign investments into Australia, followed by Japan ($20.0bn), France ($10.4bn), Singapore ($9.3bn), Germany ($6.4bn), Canada ($6.3bn), the United Arab Emirates ($4.9bn), China ($4.2bn), Chile ($1.3bn) and Ireland ($1.2bn).

Entering into the top 10 investor countries by value were Chile and Ireland, showing diversification in the foreign countries making direct investments into Australia. Chinese foreign investment (by value) has declined. The total value of commercial investment proposals in FY24 for each of the quarters was as follows: Q1 2023/2024 ($49.5bn); Q2 2023/24 ($37.2bn); Q3 2023/24 ($26.4bn); Q4 2023/24 ($58.7bn).

As for investments into Australian residential real property, the full FYE 30 June 2024 figures (by value) show China ($2.6bn) was the top source, followed by Hong Kong, Taiwan, India, Vietnam, Nepal, Singapore, Indonesia and United Kingdom – all between $0.4bn and $0.1bn for FY24.

Top investors – looking at data for the FYE 30 June 2024

The top 10 countries investing into Australia over the FY24 financial year, and changes from FY22 through to FY24, are:

Value $billion (number)

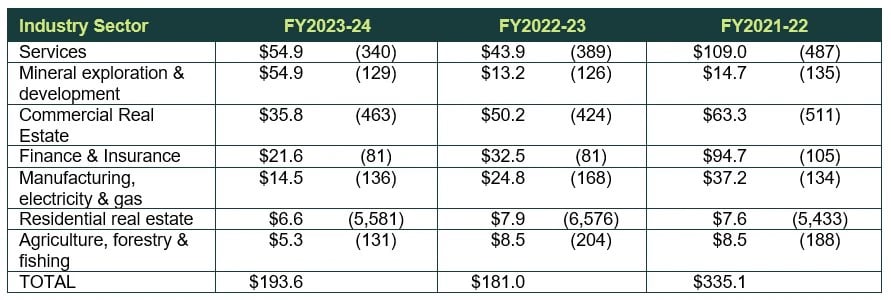

Investment by industry sector – FYE 30 June 2024

Continuing the trend of direct investment most of the preceding quarters in FY24, the mineral exploration & development (Q3/24: $5bn; Q4/24: $8.5bn; FY24: $54.9bn) and the services (Q3/24: $8.3bn; Q4/24: $27.3bn; FY24: $54.9bn) were the top two industry sectors attracting the largest amount of direct foreign investment for last financial year. The next best industry sector was commercial real estate (Q3/24: $7.8bn; Q4/24: $12.7bn; FY24: $35.8bn) with the rest of the industry sectors lagging behind these 3 industry sectors in FY24.

This result for the mineral exploration & development sector is substantially higher direct foreign investment than for the previous two financial years. This FY24 result for the mineral exploration & development sector represents 28.4% of the total value of approvals sought in FY24, compared to 7.3% in FY23 and 4.4% in FY22.

By way of contrast, direct foreign investment into the finance & insurance sector has declined as a percentage of total direct foreign investment – FY22: 28.3%; FY23: 18.0%; FY24: 11.2%. The commercial real estate sector has fluctuated greatly from year to year, as a percentage of total direct foreign investment – FY22: 18.9%; FY23: 27.7%; FY24: 18.5% – and the services sector has been relatively stable over the last three financial years, as a percentage of total direct foreign investment – FY22: 32.5%; FY23: 24.3%; FY24: 28.4% – as has the manufacturing, electricity & gas sector – FY22: 11.1%; FY23: 13.7%; FY24: 7.5%.

As identified below, over 2024 financial year, the services industry sector and the mineral exploration & development sector attracted the largest portion of investment funds into Australia. The top five industry sectors over that period otherwise remained steady: these two, plus commercial real estate, finance & insurance and manufacturing, electricity & gas.

Top industry sectors for investment – looking at data for the FYE 30 June 2024

The table below identifies the investment into the seven industry sectors over the 2024 financial year, and compares FY24 to FY23 and FY22. Notably, the service sector and the mineral exploration & development sector equally enjoyed the largest share of investment funds in Australia for the FYE 30 June 2024:

Value $billion (number)

Approved commercial investments

Of the total of 1,224 approved commercial investment proposals for FY24 (FY23: 1,315; FY22: 1,461), 472 were approved with conditions and 752 were approved without conditions. By monetary value, approximately 71.6% of these investment approvals had conditions imposed on them for FY24 ($133.8bn out of $186.9bn). This compares to 76.5% for FY23 ($132.5bn out of $173.1) and 82.0% for FY22 ($268.7bn out of $327.5bn). This represents an approximate 10% decrease over the last three financial years.

Withdrawn commercial applications

A total of 249 commercial investment proposals were withdrawn in FY24 (representing around 20.34% of total applications for FY24), as compared to 149 in FY23 (11.33%) and 195 in FY22 (13.35%).

One prohibition order and five disposal orders were issued in FY24 in respect of commercial investment applications (FY23: 1 prohibition order and no disposal orders and FY22: no prohibition orders or disposal orders).

National security applications

For FY24, of the 1,224 approved commercial foreign investment proposals, 79 applications ($2.7bn by value) related to national security actions (6.45% – 53 mandatory and 26 voluntary). These figures compare to 118 out of 1,335 (8.84% – 86 mandatory and 32 voluntary – $5.7bn by value) in FY23 and 120 out of 1,461 (8.21% – 73 mandatory and 47 voluntary – $10.1bn by value) in FY22.

This reflects a marginal decrease in the number, and material decrease by value, of national security applications as compared to FY23 and FY22.

Processing times

In FY24, 42 days was the median processing time for approved commercial investment proposals, marking a return to the results of FY23 (41 days) and a decrease from the median processing time of 52 days in FY22. Seventy-two percent of approvals in FY24 were considered in less than 60 days, including 35 percent in 30 or less days. This mirrors the FY23 period (noting a slight decrease in the percentage of approvals determined in 30 days or less (33%), and 71% of approvals in FY23 were considered in less than 60 days). Both FY23 and FY24 processing times have improved significantly since FY22, where only 59% of approvals were considered in less than 60 days including 22% in 30 or less days.

While processing times remain above the statutory timeframe for the majority of approvals, as previously predicted in prior articles, with the advent of the new foreign investment policy reforms, the processing times have fallen, at least for some repeat investors, and those investing in non-sensitive businesses. FIRB is endeavouring to further shorten these processing times.

Register of Foreign Ownership in Agricultural land

The Federal Treasury released a report on the Agricultural land ownership register for FY23 on 5 November 2024.

Some of the key points in the report are:

- the total area of agricultural land in Australia with a level of foreign ownership decreased by 0.3% in FY23 to 47.561 million hectares (from 47.709 million hectares in FY22). Total Australian agricultural land in FY23 was 368,934 million hectares;

- in FY23, the number of foreign held agricultural land properties decreased by 1,816 properties (17.6%) from 10,313 properties in FY22 to 8,497 properties in FY23;

- Australian agricultural land with foreign ownership is used for livestock, crops, forestry, non-farming and intensive horticulture, in that order of prevalence – with over 87% of Australian agricultural land with foreign ownership used for livestock;

- 82% of Australian agricultural land owned by foreign persons is owned on a leasehold basis;

- in FY23, the level of foreign ownership in Australian agricultural land by foreign persons in the top 10 countries amounted to an aggregate of 8.8%, which was made up of: China (2.1%), United Kingdom (2.0%), Canada (0.8%), the Netherlands (0.6%), United States (0.6%), Bahamas (0.6%), Switzerland (0.6%), Germany (0.6%), South Africa (0.5%) and Hong Kong (0.4%); and

- in FY23, the level of foreign held agricultural land decreased in Northern Territory, Queensland, Tasmania and South Australia, and increased in Western Australia, Victoria and New South Wales.

Register of Foreign Ownership in Water entitlements

Along with the other reports, the Federal Treasury released data on foreign ownership of water entitlements for FY23.

Some of the key points in the report (using ABS statistics) are:

- the total volume of water entitlements in Australia with a level of foreign ownership increased by 6.04% in FY23 to 4,775 GL (from 4,503GL in FY22). Total Australian water entitlement on issue in FY23 was 40,298 GL;

- the estimated proportion of water entitlements with a level of foreign ownership was 11.8% in FY23, which has increased from 11.3% in FY22 and 11.0% in FY21;

- the main uses of foreign held water entitlements are agriculture (67.7%) and mining (18.0%);

- the top four water entitlement holders by country as a proportion of the total Australian water entitlement on issue are Canada (2.5%), the United States (1.8%), China (0.9%) and the United Kingdom (0.8%);

- there was an increase in the amount of foreign held water entitlement in each state in FY23 when compared to the prior FY, except for South Australia with a decrease of 12.1% and Western Australia with no change,

Key takeaways

Foreign investors (and sellers), where FIRB approval is required to effect a transaction, should continue to be mindful of the fact that FIRB approvals will, generally speaking, likely be approved out of the statutory time period. This should be factored into sunset or end dates in agreements by which FIRB approval needs to be obtained. While the Australian Treasurer has announced a new target of processing time of 50% of cases to be dealt with within the statutory timeframe from 1 January 2025, the effects of that are yet to be seen.

If you would like to know more about how your foreign investment application could be affected by these trends, please contact us.

Get in touch