Mandatory climate-related financial reporting to commence in 2025

Legislation requiring large Australian entities and asset managers to make climate-related financial disclosures passes through Senate and is set to commence 1 January 2025.

The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 has passed through both Houses of Parliament on 9 August 2024, establishing the country's new mandatory climate-related financial reporting regime. This legislation, aligned with international accounting standards, requires large corporations that exceed specific thresholds to include climate-related financial disclosures in their annual reports (via a new sustainability report) for the financial year commencing 1 January 2025 onwards.

The Australian Accounting Standards Board (AASB) is in the process of creating climate disclosure guidelines tailored to Australian companies, expected to be finalised in September. Meanwhile, the Australian Auditing and Assurance Board (AUASB) is preparing assurance frameworks for these climate disclosures, anticipated to be available by late 2024.

Changes to the regime: Scenario Analysis to include global temperatures which "well exceed" 2°C

The Senate required one significant change to the regime, which is reflected in the final legislation.

Under the AASB’s draft Australian Sustainability Reporting Standards released in October 2023, entities were expecting to assess their climate resilience in their financial reports against at least two future global temperature scenarios. The first scenario, aligned with the Climate Change Act 2022, assumes a temperature rise limited to 1.5°C above pre-industrial levels. The draft standards did not specify a second scenario, which was at the discretion of the entity. However, the changes to the legislation made by the Senate effectively mandate that entities analyse their resilience against a scenario where global temperatures “well exceeds the increase mentioned in subparagraph 3(a)(i) of the Climate Change Act 2022”, that increase being 2°C above pre-industrial levels. The Supplementary Explanatory Memorandum has stated that “well exceeds” 2°C means an increase of “2.5°C or higher” (see also sub-section 296D(2B)(a) of the Bill). This higher scenario aims to account for more extreme climate risks and mirrors frameworks used in physical risk assessments such as Australia’s National Climate Risk Assessment.

The new legislative requirement for a scenario which “well exceeds” 2°C now aligns with the Greens position, who pushed for mandatory disclosures addressing higher temperature outcomes. This higher scenario is also more stringent than the Paris Agreement’s goal of limiting temperature rises to well below 2°C, as well as the Taskforce on Climate-Related Financial Disclosure’s framework, which does not mandate consideration of scenarios beyond 2°C.

Regime otherwise unchanged

Other than the above changes to scenario analysis, the Bill was passed unamended from its initial form. However, there was considerable debate in the House of Representatives, particularly relating to the inclusion of scope 3 emissions and the modified liability provisions.

The following critical details of the regime remain unchanged:

- Scope 3 reporting: Disclosure of scope 3 emissions is only expected to be required from an entity's second reporting year onwards.

- Temporary “limited immunity”: A temporary "limited immunity" framework will apply for the first three years of reporting, applying to inherently uncertain statements about scope 3 emissions, scenario analysis or a transition plan.

- Content of sustainability report: The sustainability report will include climate statements for the year in line with the ASRS and, for the first three years, a director’s declaration that the entity has taken reasonable steps to ensure the climate statements are in accordance with the Corporations Act.

- Audit and assurance: Initially, the sustainability report will only be required to be reviewed or audited to the extent required by the audit standards made by the AUASB. From 1 July 2030, audit and assurance requirements will be phased in, being a positive assurance that the report complies with the Corporations Act and applicable AASB standards.

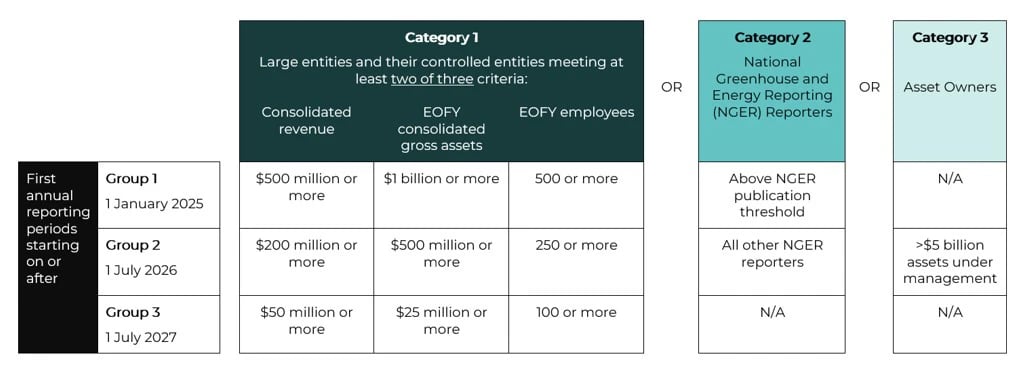

- Reporting entities and timeline: The thresholds for captured entities and the timeline for the phased-in approach of the regime remain unchanged.

Key takeaways

The reporting will be required for Group 1 entities for the financial year commencing 1 January 2025. This will be closely followed by large asset managers with greater than $5 billion under management which are captured as a Group 2 entity who will need to start climate-related financial reporting from 1 July 2026.

Those entities that have not voluntarily been reporting under the Taskforce for Climate-Related Disclosures may have significant preparatory work to do in order to integrate climate metrics and targets and scenario analysis into the risk management, strategy and governance of their organisation. The scope 3 reporting is also a considerable undertaking for those entities that have large or complex supply chains.

Corporates and directors should take care and seek appropriate advice to ensure that directors’ declarations are robustly verified and disclosures (together with related public statements) are appropriately audited to avoid greenwashing risks, particularly in the early years of reporting under the new regime. We expect that these disclosures will be heavily scrutinised by shareholders, potential investors, interest groups and, of course, ASIC. ASIC’s new regulatory guide for the climate reporting regime and other resources for those who prepare and use sustainability reports is expected later this year.

Get in touch