Co-locating batteries with data centres in Australia's National Electricity Market

Pairing data centres with utility-scale batteries can offer energy cost savings, improved resilience, and multiple revenue streams. Success depends on site selection, regulatory compliance, advanced operational controls, and choosing the right ownership or commercial structure.

According to recent reports, Australia’s data centre deployable capacity will more than double to 3100 MW by 2030. In a significant development for the sector, Supernode data centre owner Quinbrook Infrastructure Partners announced on 16 April 2025 the addition of one gigawatt hour of capacity to the co-located battery energy storage system (BESS) at its Brisbane campus – making it the largest BESS in Australia.

Co-location with a utility-scale BESS presents a compelling opportunity for data centre operators and infrastructure investors to reduce energy costs, improve operational resilience, and unlock multiple revenue streams through what is known as "revenue stacking".

Batteries as strategic infrastructure

In Australia’s National Electricity Market (NEM), which spans five states and accounts for over 80% of the country’s electricity consumption, batteries are increasingly playing a critical role in stabilising the grid and integrating renewable generation.

Co-locating battery storage with data centres in the NEM is not just an energy efficiency play – it’s a strategic infrastructure decision. A rapid decline in battery prices (and, so, lower initial capital cost) offers a unique opportunity to combine energy cost savings, enhanced resilience, and multiple income sources through market-facing services.

For investors, this means exposure to both digital infrastructure and Australia’s booming renewable transition. For data centre operators, it’s a route to future-proof energy operations, meet sustainability expectations, and control an increasingly volatile cost base.

Revenue stacking

"Revenue stacking" refers to the practice of using a BESS to earn income from several services or market roles.

A BESS co-located with a data centre offers a number of potential market revenue opportunities:

Frequency control ancillary services: The NEM places high value on fast-response assets that can quickly respond to frequency deviations. Batteries are ideally suited for these services, often earning a substantial portion of their revenue from frequency control ancillary services (FCAS), with payments for both "availability" and delivery of the services.

Network support and constraint relief: In areas of the grid that experience congestion or are distant from generation, BESS can provide localised support services that earn additional network or non-market payments.

Energy arbitrage: Charging the battery during periods of high supply or low demand, and low or negative prices, then discharging into the grid during peak intervals and 'banking' the difference. NEM spot prices can range from -AU$1,000 to AU$17,500, and with more than 4 million residential rooftop solar systems operating in the NEM (about 25% of total generation), spot prices were negative 23.1% of the time in Q4 2024, generally during the middle of the day. In volatile pricing environments like South Australia, arbitrage can be especially profitable.

By "stacking" these revenue streams, investors can potentially significantly improve the return on a battery asset, while data centre operators can benefit from reduced costs and greater control over energy use.

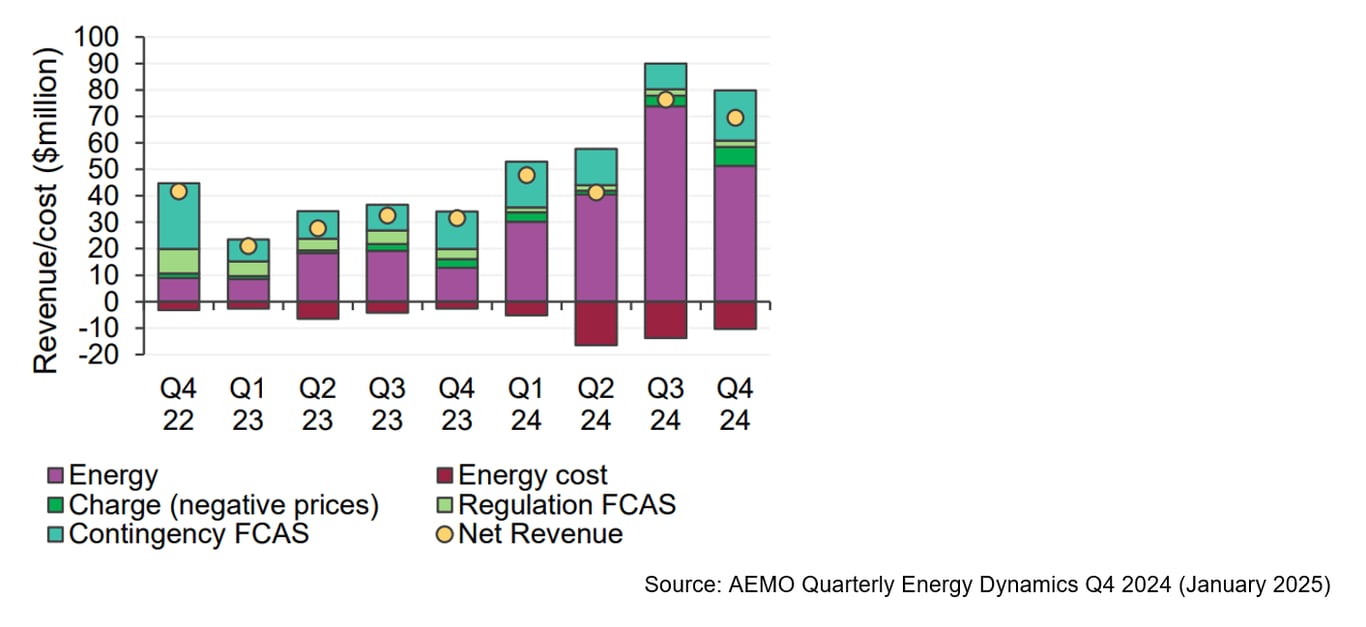

According to the latest figures from the Australian Energy Market Operator (AEMO) for Q4 2024, energy market net revenue for batteries, largely from energy arbitrage, represented 69% of total estimated net revenue. During this period, batteries charged at an average cost of $47/MWh and dispatched at an average price of $309/MWh:

Strategic benefits for Australian data centres

In the context of Australia’s rapidly evolving energy landscape, the strategic rationale for co-locating batteries with data centres is strong:

Improved resilience and reliability: The NEM has experienced blackouts and reliability issues in recent years. On-site batteries provide immediate backup and avoid sole reliance on, for example, diesel generators, supporting operational continuity.

Energy cost reduction: Spot market volatility in the NEM can be extreme. Batteries help hedge against this volatility, especially when paired with wholesale demand response capabilities.

Peak demand management: For market customers paying spot prices in the NEM, batteries can be scheduled charge from the gid during low demand intervals (during the middle of the day) and be used to power operations during local peak demand intervals (usually, during the early evening) to hedge exposure to spot price volatility and reduce overall energy costs.

Capacity firming for renewables: Co-located batteries can help firm renewable supply, making solar and wind energy more viable for 24/7 data centre operations.

Sustainability and net zero alignment: Australia is moving rapidly toward net-zero, with large energy users increasingly expected by government and clients to demonstrate low-carbon operation. Co-located batteries support renewable integration and coupled with virtual power purchase agreements or behind-the-meter energy generation.

Participation in emerging markets: The ongoing development of "two-sided markets", distributed energy resource integration, and capacity mechanisms mean new roles are emerging for flexible assets like BESS.

Other considerations

When planning a co-located battery in the NEM, investors and operators should consider:

Location: Revenue opportunities differ markedly by State and region. FCAS pricing, network tariffs, and residential solar penetration vary, with flow-on effects for battery operating costs and revenue opportunities.

Regulatory approvals: Connecting into and participating in electricity markets is highly regulated. In addition to local, state and federal planning, environmental and project approvals, projects need to satisfy technical and other performance and regulatory standards under national electricity laws, initially to secure a grid connection and to register as a market participant, and then on an ongoing basis. State or local laws may otherwise require a permit or exemption to operate a BESS as part of an "embedded network" (a private electricity network that supplies the data centre).

Operations and dispatch: Sophisticated control systems are essential to manage participation in multiple markets, especially when coordinating between "behind-the-meter" usage (consumption by the data centre) and market-facing services.

Project delivery: Consider whether the BESS should be developed, built and owned by the data centre owner/operator, a third party, or a joint venture, and for new data centre developments, whether the BESS should be procured and delivered as part of the data centre project or on a stand-alone basis, as a separate, co-located project.

Commercial operation: In some cases tolling or leasing arrangements may be appropriate, including where the data centre operator may not have the technical capability to operate and trade the BESS. Other, more novel approaches include revenue sharing or swaps.

Case study: Battery tolling at Supernode Data Centre

Quinbrook Infrastructure Partners is advancing its $2.5 billion Supernode project at its Brendale campus in Queensland, Australia, integrating four hyperscale data centre installations with what will be Australia's largest battery energy storage system. The BESS is being developed in three stages. In late 2024, Quinbrook entered into tolling arrangements with Origin Energy for the first two stages (520 MW/1,856 MWh) and Queensland Government-owned generator Stanwell Corporation for the third stage (250 MW/1,010 MWh). Under tolling arrangements, the BESS is "leased" to a third party to operate, maintain and earn NEM market revenue from (and pay market costs for), in exchange for fixed "rent" payments. A battery owner will want to ensure a tolling agreement clearly defines operational limits, performance (incl. degradation) and a framework for identifying, assessing and resolving performance issues, including parties' roles, responsibilities and liability, in order to protect asset performance and longevity.

Growing momentum in the Australian market

Co-locating battery storage with data centres in the NEM is a strategic infrastructure move that leverages falling battery costs to unlock energy savings, operational resilience, and diverse revenue streams from market-facing services. As Australia’s energy transition accelerates alongside rising computational demand, more data centre operators and investors are likely to explore the opportunities presented by co-located battery storage.

Get in touch