Payday plus 7 days: proposed Payday Super reforms released

Employers must be aware of the new Payday Super obligations and ensure their payroll administration systems are ready or risk significant penalties.

On 14 March 2025, the Treasury released the exposure draft for the Federal Government's previously announced Payday Super reforms. The reforms propose amending the time limits imposed on employers to pay superannuation guarantee (SG) contributions for their employees from a quarterly basis to within 7 calendar days of the payment of ordinary time earnings (OTE).

The Government's Payday Super reforms were first announced in the "Securing Australians' Superannuation Package" in the 2023-24 Federal Budget and follows extensive consultation conducted by the Australian Taxation Office (ATO) Payday Super Working Group. The current exposure draft builds on the Treasury's Payday Super factsheet that was released on 18 September 2024 which provided a first glimpse of the proposed reforms.

Set to commence on 1 July 2026, the Payday Super reforms would make sweeping changes to the administration of superannuation in Australia. The reforms are in draft and are subject to change following the end of the consultation period on 11 April 2025. However, reform progress may be impacted by government caretaker procedures due to the upcoming federal election on 3 May 2025. We will be keeping a close eye on the status of the reforms, including whether any significant changes are introduced following the election.

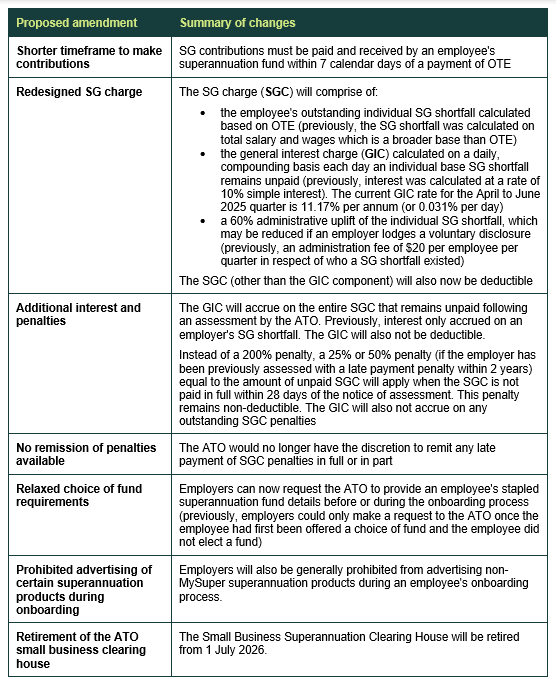

The Payday Super reforms are summarised below:

We detail below some of the key proposed changes for employers.

Shorter timeframe to make contributions

Current law

The current drafting of the Superannuation Guarantee (Administration) Act 1992 (Cth) (SGAA) does not impose an explicit obligation on employers to pay SG contributions for the benefit of their employees. Instead, the SGAA requires that a minimum amount of SG support must be provided to employees so as to avoid the SGC. Currently, employers are only required to pay superannuation contributions 28 days after the end of the relevant quarter (which is 28 October, 28 January, 28 April and 28 June). An employer becomes liable to the SGC if they fail to provide the minimum level of SG support (currently 11.5%) to an employee on amounts that constitute OTE for a quarter (subject to certain exceptions). OTE includes many common types of payments for an employee's ordinary hours of work, including ordinary pay, bonuses (excluding for overtime), many types of leave and other regular payments made in respect of an employee's ordinary hours of work at ordinary rates of pay.

Proposed law

The Treasury Laws Amendment Bill 2025: Superannuation guarantee reforms to address unpaid super aims to amend the SGAA to ensure the payment of SG contributions broadly aligns with the timing of the payment of an employee's ordinary pay.

The proposed reforms enshrine an obligation for employers to pay SG contributions for the benefit of their employees if an employer has an "individual SG amount". The "individual SG amount" arises when an employer makes a payment of "qualifying earnings" to or for an employee on a particular day (known as the "QE day").

"Qualifying earnings" include not only OTE, but also:

commissions;

payments to, and remuneration of, persons that are deemed to be employees for the purposes of section 12 of the SGAA; and

amounts that have been salary sacrificed in exchange for additional SG contributions.

SG contributions at the charge percentage (12% from 1 July 2025) must be received by the relevant superannuation fund within 7 calendar days after an employer makes a payment of qualifying earnings or the employer will be liable to the SGC. The effect is that employers that pay on-time SG contributions within the 7-day period will reduce their individual base SG shortfalls for a QE day (including to nil, which would avoid imposition of the SGC).

Certain time extensions to pay and receive SG contributions apply, including:

new employees – employers will generally have a 14-day extension to make eligible contributions;

out-of-cycle payments – the Commissioner may by legislative instrument designate certain payments as out-of-cycle payments which extend the SG contribution due date to the next QE day (which will vary from employer to employer). Out-of-cycle payments may include commissions, bonuses, payments in advance and back payments;

exceptional circumstances – include natural disasters and widespread outages of information and communication technology services affecting multiple employers on a large scale, 21 days from the QE day (ie., a 14-day extension);

where a stapled superannuation fund provided by the Commissioner does not accept the SG contribution, 42 days from the QE day (ie., a 35-day extension); and

where an employer's default superannuation fund fails APRA performance tests, 42 days from the QE day (ie., a 35-day extension).

Additional changes include:

late payment offsets – currently, employers can elect to pay the SG shortfall to the employee's superannuation fund with the ATO offsetting that amount against the employer's nominal interest component (with the remainder applied to the SG shortfall). These payments will now be automatically applied to reduce an employer's individual final SG shortfall (explained below);

maximum contributions base – will be calculated on an annual rather than quarterly basis;

shortfall exemption certificate – amendments to simplify the process, including changing the qualifying conditions to receive an exemption certificate; and

defined benefit schemes – amendments to the SGAA to ensure the proposed changes preserve the existing contribution framework with respect to defined benefit schemes.

Redesigned SG charge

Current law

Currently, if SG contributions are not paid by the relevant quarterly due dates, the employer becomes liable to a non-deductible tax called the SGC which has three components:

SG shortfall – an employee's unpaid or underpaid superannuation amount calculated on an employee's total salary or wages. This is a broader base than OTE and includes items such as overtime and termination payments for unused annual, long service or sick leave;

nominal interest – 10% simple interest on the SG shortfall for the quarter accruing from the start of the relevant quarter until the SGC becomes payable; and

administration fee – $20 per employee per quarter in respect of whom there is a SG shortfall.

Proposed law

The reforms propose a significant rewrite of the SGC and involve the following new components:

the total of the employer's individual final SG shortfalls;

the total of the individual's notional earnings components for the QE day;

the employer's 60% administrative uplift amount (if any); and

the total of the employer's choice loadings for the QE day (if any).

The sum of these four components comprise the "SG shortfall" on which the SGC is payable. Each component is discussed in further detail below.

Individual final SG shortfall

An employer's "individual final SG shortfall" for a particular employee is worked out under the following process:

Step 1: work out individual SG amount (qualifying earnings x charge percentage). This is called the "individual SG amount".

Step 2: minus eligible (on time) contributions for the QE day from Step 1. If this amount is nil, then no SG shortfall arises. If this amount is greater than nil, this is called the "individual base SG shortfall" and you must proceed to Step 3.

Step 3: minus eligible contributions (late) contributions for the QE day from Step 2. The result is the "individual final SG shortfall".

The overall effect is similar to the current SGC regime in that the "individual final SG shortfall" represents the amount of SG contributions that remain unpaid following a particular QE day after all on-time and late SG contributions (if any) have been applied.

Notional earnings components

To incentivise employers to pay SG contributions on time, and to compensate employees for lost superannuation fund earnings due to late contributions, an "individual notional earnings component" will apply. This involves multiplying the individual base SG shortfall amount for the employee by the GIC rate, which is currently 11.17% on an annual basis and 0.031% on a daily basis. The GIC will apply on a compounding, daily basis and will accrue for each day an employer's final SG shortfall is greater than nil.

Under these proposed changes, interest effectively accrues where insufficient SG contributions have been paid to an employee notwithstanding if late SG contributions are later made. Interest will cease accruing once an employee receives their correct SG entitlements.

Administrative uplift

One of the more significant changes to the redesigned SGC is the administrative uplift. A 60% administrative uplift will apply to the total of an employer's individual final SG shortfall amount, representing a large increase on the current $20 administration fee per employee per quarter.

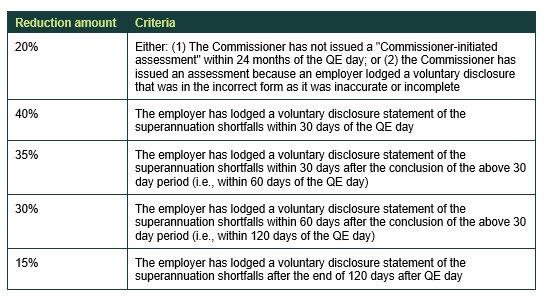

The 60% administrative uplift amount may be reduced, including to nil, by the following amounts if the relevant criteria are satisfied:

The key takeaway is that an immediate 20% reduction of the administrative uplift is available if the Commissioner has previously not made an assessment within 24 months and further reductions ranging from 40% to 15% are available if the employer lodges a voluntary disclosure within 30 to 120 days or later after the QE day.

Choice loadings

Currently, an employer will be liable to a choice shortfall if they fail to comply with their choice of fund obligations. A choice shortfall results in a 25% uplift in an employee's SG shortfall (limited to $500 per notice period per employee).

Under the proposed reforms, a choice shortfall will remain but form a separate component of the SGC. The choice shortfall cap will increase to $1,200 per notice period.

Additional interest and penalties and administration

Current law

Currently, if an employer fails to pay the SGC or lodge SG statements on time, an employer becomes automatically liable to a penalty equal to 200% of the SGC (however, while an employer becomes automatically liable to this penalty, it is payable only when the Commissioner issues an assessment). Other administrative penalties, such as penalties for false or misleading statements and aggravating circumstances, may also apply, and the GIC accrues on the SG shortfall component of the SGC.

Proposed law

The proposed reforms significantly alter the administration and penalties for SG non-compliance. The effect of those changes is summarised below:

an employer becomes liable to the SGC if SG contributions are not paid within 7 days of the payment of OTE;

an employer may pay the SGC (via a voluntary disclosure in the approved form) before the Commissioner issues an assessment to reduce the administrative uplift component of the SGC. The lodgement of SG charge statements is no longer required;

the Commissioner may at any time issue a notice of assessment to the employer to pay the SGC; and

if the SGC remains unpaid within 28 days of notice of assessment:

GIC will accrue from the date it is due and payable (effectively resulting in double interest as GIC is already levied on the notional earnings component of the SGC); and

the Commissioner will issue a written notice instructing the employer to pay. Administrative and unremittable penalties of 25% or 50% of the outstanding amount will also apply and become payable at least 14 days after the Commissioner issues a notice of assessment.

Key takeaways

The proposed Payday Super reforms, if passed by parliament, significantly alter the current superannuation administration landscape. The key implications for employers are as follows:

employment terms and conditions (including under contracts of employment, workplace policies and applicable industrial instruments) may need to be updated to reflect that SG contributions must be received by superannuation funds within 7 days of payday. As a separate exercise, there will be a need to clearly communicate the changes to employees so they are aware of their effects.

SG contributions must be received by superannuation funds within 7 days of payday, so employers should ensure payments are made as promptly as possible, and well before the end of the 7th day, to allow for any delays in processing that are outside of their control. Employers should consider whether any adjustments are required to their current pay cycles to facilitate the faster payments.

from a record-keeping perspective, employers will be required to make and keep records of superannuation payments for each pay cycle, rather than quarterly. Employers should take steps to ensure that their record-keeping processes are sufficiently robust to facilitate the more frequent production and maintenance of superannuation records.

small and medium-sized enterprise employers, especially small businesses that currently budget for quarterly payment of SG contributions, may need to adjust their financial planning in order to facilitate payment within 7 days of payday.

the redesigned SGC appears to incentivise employers to disclose SG underpayments quickly and voluntarily. A severe upfront uplift will apply to increase late contributions by 60%. Both the uplift and overall SGC are subject to daily compounding interest, so employers that do not comply with their SG obligations before a notice of assessment is issued by the Commissioner will see the SGC accumulate at a faster and higher rate than under the current scheme.

although the proposed reforms are slated to commence from 1 July 2026, employers must act now to ensure their payroll processes and software, as well as their cash flow position, are ready to facilitate paying SG contributions at or within 7 days of payday.

given the proposed reforms also require the ATO to actively remind employers who have not met their SG obligations, further ATO compliance and enforcement action, particularly with respect to issuing penalties, can now be expected. Employers who fail to meet their SG obligations can expect to face increased scrutiny from both the ATO and employees.

as superannuation is now regulated under the Fair Work Act 2009 (Cth), employers who fail to meet their SG obligations may contravene it – meaning employers in breach of their SG obligations may also face scrutiny from the Fair Work Ombudsman and be exposed to civil penalties (although the ATO remains the primary regulator for non-compliance with SG obligations).

the passage of the reforms is highly uncertain given the federal election, and possible change of government and parliament, is imminent. Employers must stay across updates that may occur to the proposed reforms.

the ATO is currently consulting with industry on amendments that may be required to the ATO's publicly available administrative guidance on what amounts the ATO considers to be OTE. Consultation is expected to be completed in June 2025, so employers should look out for any further changes or announcements.

Please get in touch with us if you have any questions about the proposed reforms.

Get in touch