Foreign investment in Australia: key insights from the latest Quarterly Report

The Australian Treasury has released its latest quarterly report on foreign investment, covering the period from 1 July to 30 September 2024 (Q1 2024/25).

Some headline statistics and takeaways from Q1 2024/25:

- The United States continues to lead direct investment (by value and number) into Australia.

- Germany and Japan have made substantially less direct investment into Australia in Q1 2024/25 as compared with Q4 2023/24.

- The "commercial real estate" sector has dethroned the "services" and "mineral exploration & development" sectors as the largest industry sector by direct investment.

- Median processing times are improving, with almost 50% of proposals being processed within the statutory timeframe, however, foreign investors should be aware that FIRB approvals are generally still likely to be approved later than 30 days.

Australia’s top investors

The United States continues to be Australia’s largest source of foreign direct investment, with total approved commercial investment value of $22.9 billion. This is a slight uptick from the previous quarter ($21.9 billion Q4 2023/24).

The United States was followed by Singapore ($4.6 billion), Indonesia (value not disclosed), Canada ($1.8 billion) and the United Kingdom ($1.4 billion). Rounding out the top 10 investor countries were Germany, Japan, Cayman Islands, France and the United Arab Emirates, each making direct investments valued at less than $1 billion throughout Q1 2024/25.

The total value of commercial investment proposals in Q1 2024/25 dropped to $46.6 billion ($58.7 billion in Q4 2023/24).

As for investments into Australian residential property, the Q1 2024/25 figures (by value) show China ($0.4 billion) remained the top source, followed by Taiwan, Hong Kong, Vietnam, Indonesia, India and Singapore – all making investments valued at approximately $100 million for the quarter. These numbers are generally steady against the previous quarter.

Investment by industry sector

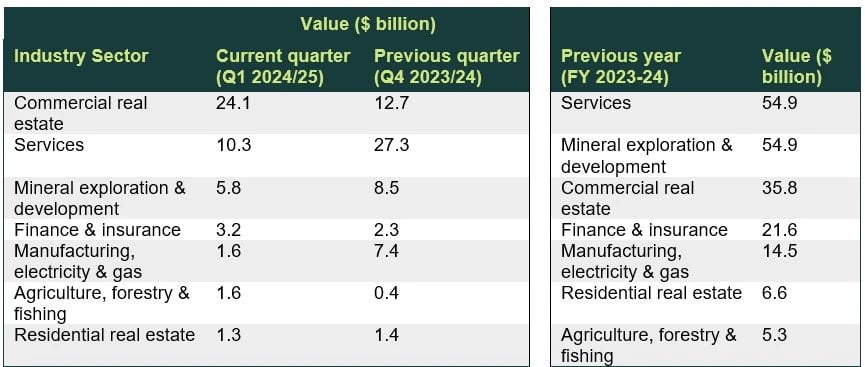

Investment in commercial real estate ($24.1 billion) dominated the market in Q1 2024/25 – dethroning the mineral exploration & development sector ($5.8 billion) and the services sector ($10.3 billion) which have historically attracted the most foreign direct investment.

Particularly, the value of direct investment into the services sector has fallen from $27.3 billion in Q4 2023/24 to $10.3 billion in Q1 2024/25, whilst commercial real estate has increased from $12.7 billion in Q4 2023/24 to $24.1 billion in Q1 2024/25.

Other key sectors this quarter included finance & insurance ($3.2 billion), manufacturing, electricity & gas ($1.6 billion) and agriculture, forestry & fishing ($1.6 billion)

Approved commercial investments

During Q1 2024/25, a total of 377 commercial investment proposals were approved, amounting to a combined value of $46.6 billion. Of the 377 commercial investment proposals, 144 were approved with conditions and 233 were approved without conditions. By monetary value, approximately 80% of all investment approvals in Q1 2024/25 had conditions imposed on them ($37.3 billion out of $46.6 billion).

Withdrawn commercial applications

During Q1 2024/25, a total of 32 commercial investment applications were withdrawn (representing around 8% of applications). A slight downturn from 43 in the previous quarter.

National security applications

Of the 377 approved commercial investment proposals, 23 were classified as national security actions. These were divided into:

- Mandatory notifications: 20 approvals (3 with conditions, 17 without conditions); and

- Voluntary notifications: 3 approvals (all without conditions).

Processing times

The median processing time for commercial investment applications was 34 days, reflecting an improvement from the previous quarter’s 41 days. 47% of approvals were considered within 30 days or less and 72% considered within 60 days or less.

Given almost 50% of decisions were made within the 30-day statutory timeframe, the advent of the new foreign investment policy reforms is seemingly working to increase the processing times (particularly for repeat investors, and those investing in non-sensitive businesses). This will continue to be a focus in 2025 as the Australian Treasurer announced a target of processing time of 50% of cases to be dealt with within the statutory timeframe from 1 January 2025.

During the Q3 and Q4 2024/25, FIRB is looking to implement its new Foreign Investment Portal as part of its efforts to enhance the management of foreign investment applications and compliance reporting. This portal is being rolled out in stages, with key functionality becoming available at different times, mainly in Q4 2024/25. It will be interesting to see whether this has any impact on processing time.

For businesses and investors looking to navigate Australia’s foreign investment landscape, we recommend staying informed about regulatory changes and investment trends. If you require legal guidance on foreign investment applications, please contact us.

Get in touch