Miramax and Tarantino settle Pulp Fiction NFT dispute leaving NFT intellectual property issues in the valley of darkness

One of the first high-profile US intellectual property cases involving NFTs has settled, meaning it is more important than ever to carefully consider the various intellectual property issues which may be relevant to the creation and commoditisation of NFTs.

Hollywood director, cult classic film and major production company – the stage was set for a truly breakthrough debut performance as a US Court was poised to wade into the milieu of intellectual property issues that arise from non-fungible tokens. However it looks like this area of law will have to wait a little longer for its moment in the spotlight, with Miramax and Quentin Tarantino settling their dispute which caught international media attention.

The case was first commenced back in November 2021, when film studio Miramax sued Pulp Fiction director, Quentin Tarantino for breach of contract, copyright infringement and trade mark infringement. The allegations arose from a collection of NFTs based on based on the cult favourite film which were said to comprise "exclusive scenes" from Tarantino's hand-written script of the movie.

Most jurisdictions, including Australia, have yet to develop specific regulatory frameworks for NFTs, meaning that we are once again left to wonder how our existing intellectual property laws will apply to these once unimaginable assets. While the US suit between Miramax and Tarantino would not have settled the law on this topic, particularly in Australia, it would have been the perfect opportunity for a court to grapple with some of the very issues which are likely to be highly relevant to the Australian legal landscape and thus, the settlement of the case means we are left waiting a little longer for some guidance on this emerging area of controversy.

Everybody be cool; this is an NFT

On 2 November 2021 a press release announced that Tarantino would be auctioning off 7 uncut Pulp Fiction Scenes as Secret NFTs on OpenSea, the world's largest marketplace for the sale of NFTs. What made these NFTs so special was that each was described as containing "one-of-a-kind" content that had never been heard or seen before. This new content was to include the uncut first handwritten scripts of Pulp Fiction and exclusive commentary from Tarantino, customised to reveal secrets about the film and its creator. On top of this, the "front cover" and public metadata for each NFT were to be rare in their own right. These NFTs would be publicly represented by unique, never before seen works of art, with the secret content only accessible by the owner of the NFT.

The buzz around these NFTs was instant and pervasive. Tarantino created a specific website associated with the NFTs which also used images of the iconic characters from the film:

These "secret NFTs" would be some of the first to contain these new access restriction features and for that reason were gaining interest well beyond fans of the film.

Gettin’ medieval on copyright and trade mark infringement allegations

Among the allegations outlined in Miramax's complaint, filed in the federal court in California in November 2021, were complaints of both copyright infringement and trade mark infringement. Through a complex set of assignment agreements, Tarantino and the production company responsible for Pulp Fiction had assigned all copyright in the motion picture and all elements thereof in all stages of development to Miramax. As part of the contractual arrangements, Tarantino retained a very limited set of intellectual property rights, one of which being the right to publish the screenplay of the film.

Separately, Miramax claimed to be the owner of various registered and unregistered trademarks relating to Pulp Fiction, including the word mark PULP FICTION, which it claimed Tarantino infringed through his Pulp Fiction NFTs. Miramax also included complaints relating to breach of contract and unfair competition under the Lanham Act.

Marvin, what do you make of all of this legal argument over NFTs?

Other cases on the horizon include Hermès' dispute with Mason Rothschild over the "MetaBirkins" which have now been removed from NFT marketplace OpenSea following the January 2022 filing of proceedings in the US Court and the Nike v StockX dispute regarding NFTs of Nike's famous kicks which was filed in the US District Court of New York in February 2022.

Examples of Rothschild's "MetaBirkins"

One of the NFTs at the heart of the dispute between Nike and StockX

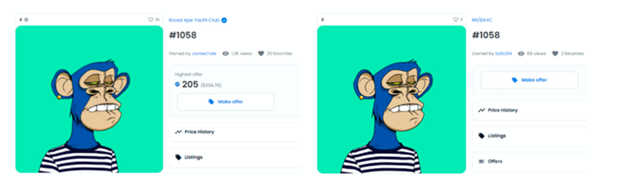

Another headline case in this space involves the Bored Ape Yacht Club NFT Collection, one of the most well-known collections of digital art NFTs on the market. The company behind the iconic NFTs has filed a suit in the Central District of California in June against copycat artist Ryder Ripps alleging that Ripps has engaged in unfair competition, false advertising, cybersquatting and trade mark infringement, among other things. We, along with interested lawyers around the globe, are eagerly tracking the progress of each of these cases, hoping that with each decision, more clarity is shed on this area.

Side by side comparison of a Bored Ape Yacht Club NFT (left) and the copycat NFT by Ryder Ripps (right)

What to expect in Australia

While there are currently no Australian intellectual property disputes before the Federal Court which canvass these issues, it is important to keep in mind that similar issues are likely to apply in the Australian context. Some businesses have begun taking proactive steps to protect themselves in this space, including through applying for or amending their trade mark registrations to ensure they cover NFTs. This is likely to prove crucial if (and more likely when) these types of cases reach Australian shores and trade mark infringement claims involving NFTs begin to appear.

Please contact Clayton Utz if you would like any assistance or advice relating to the intellectual property rights involved in NFTs, conducting intellectual property due diligence or are concerned that another trader may be infringing your intellectual property rights.

Get in touch