Real estate: 5 Minute Fix 05

Alert: The first of the seven-year PPSR registrations are about to expire

The Personal Property Securities Register was seven years old on 30 January 2019. Security interests with seven-year registration periods, including registrations against serial numbers and/or consumer goods (if made in 2012), unless renewed, automatically expired on 30 January 2019.

Read more here: Some PPSA registrations are about to expire - don't get caught out

PEXA increases limit to $9 billion

The new threshold for PEXA financial settlement is $9 billion, up from the previous $99,999,999.99 maximum. Any transaction equal to or less than $9 Billion can now be settled through PEXA.

The NSW Conveyancing Monetary Consideration Waiver for NSW transactions over the $99,999,999.99 threshold remains in place and is scheduled to expire on the earlier of 30 June 2019 or public revocation by the Registrar. You can access a copy of the Waiver here.

Update: PEXA participation rules version 5 now apply

From 25 February 2019, you must comply with version 5 of the Participation Rules. The Rules for each State are available here:

NSW: Land tax exemption for lessees from NSW Land and Housing Corporation

The new Land Tax Management Regulation 2019commenced on 15 February 2019. The Regulation provides that a lessee of land from the NSW Land and Housing Corporation is not required to pay land tax on the land if:

(a) the dominant purpose of the lease is to enable the lessee to provide housing (which may include social and affordable housing), and

(b) the lease has a term of at least 10 years.

affordable housing has the same meaning as in the Environmental Planning and Assessment Act 1979.

social housing means residential accommodation provided by a social housing provider within the meaning of the Residential Tenancies Act 2010.

The Regulation is made under the Land Tax Management Act 1956, including sections 21C(6)(a) and 82 (the general regulation-making power).

NSW: Retirement Villages Amendment Act 2018 (NSW) now in force

The Retirement Villages Amendment Act 2018 (NSW) received Royal Assent on 28 November 2018, with Schedule 1 [10] and [17]–[20] commencing on 11 February 2019. The Act amends the Retirement Villages Act 1999 (NSW) to give effect to some of the recommendations of the Inquiry into the NSW Retirement Village Sector, including:

- requirement for village operators to prepare and maintain an emergency plan for the village and undertake annual evacuation exercises;

- right for residents to request an annual contract information meeting with the operator so that the residents are better informed of their rights and obligations;

- requirement that village operators maintain an asset management plan for a village's capital items and make the plan available to residents;

- operators to ensure the accounts of the village are audited annually;

- residents' consent is required to the appointment of a qualified auditor; and

- giving a regulation-making power to enable Fair Trading to collect, share and publish retirement village sector information.

NSW: Electronic lodgement of leases now available

The NSW Government has committed to having all standard conveyancing transactions lodged electronically by 1 July 2019. Further information on what types of transactions must be lodged electronically can be found here.

Over the next 12 months many other document types will be able to be lodged electronically. These new document types are not mandated and will give practitioners the choice between using the electronic or the paper channel.

From Monday 10 December 2018, PEXA began supporting the electronic lodgement of leases. These may be lodged as a standalone document, or along with a Transfer of Land, or with a series of other leases (ie. consecutive leases). You’ll need to be registered with PEXA to be able to lodge Leases electronically.

Electronic lodgement of a lease is not currently mandated, and there are certain leases that are not able to be lodged electronically. For the full list of leases that are not able to be lodged electronically, and information to assist you complete electronic leases, please see the RG’s Guidelines.

Qld: updated Land Title Practice Manual

The Land Title Practice Manual (Qld) has been updated, effective from 13 December 2018.

A tracked changes version which outlines the changes to the relevant parts has been released, including a summary of the published changes. Details of the changes are available from the Land Title Practice Manual Page.

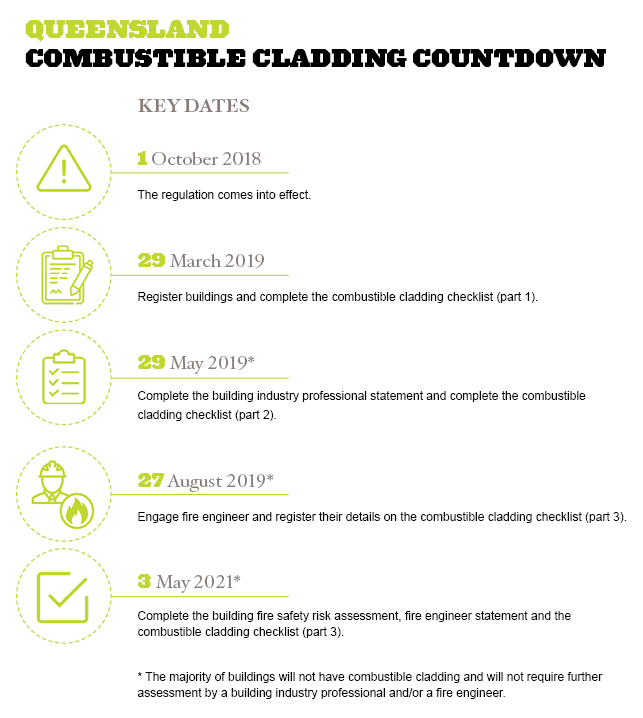

Qld: affected building owners to complete stage 1 of online combustible cladding checklist by 29 March

The process is aimed at identifying buildings in Queensland that may contain potentially combustible cladding. The Queensland Government regulation applies to buildings that are:

- privately or government owned;

- Class 2 – 9;

- of a type A or B construction; and

- were built, or had the cladding altered after 1 January 1994 but before 1 October 2018.

Owners of these buildings must register and complete part 1 of the online checklist by 29 March 2019. Further assessment (if required) must be completed by 29 May 2019. Affected buildings will be required to display a notice on the building and provide copies of risk assessments to lot owners and tenants.

More detail can be found on the "Safer Buildings" website.

Related Insights

Get in touch