Clearer triggers and processes for Melbourne Environment Mitigation Levy

As from 1 July 2020, the Melbourne Strategic Assessment (Environment Mitigation Levy) Act 2020 established a new Victorian legislative framework for the existing Melbourne Strategic Assessment program that has operated since 2010 under Commonwealth Environment Protection and Biodiversity Conservation Act (Cth) approvals.

What is the purpose of the Act?

The purpose of the Act is to impose an environment mitigation levy to fund measures to mitigate the impacts on the environment caused by land development in Melbourne's growth corridors. The levy replaces the Biodiversity Conservation Strategy Habitat Compensation Obligations fee system.

What land is affected?

The levy applies to land in certain "levy areas" in the four growth corridors within the expanded Melbourne 2010 Urban Growth Boundary, which includes land in the municipalities of Cardinia, Casey, Hume, Melton, Mitchell, Whittlesea and Wyndham.

A key feature of the administration of the Act is the recording of a notice on land titles (similar to notice of a Growth Area Infrastructure Contribution (GAIC) recording) to indicate that an undischarged levy applies to that land. A notice was recorded by Land Use Victoria on land titles across Melbourne’s growth corridors immediately upon commencement of the Act on 1 July 2020.

The areas which are subject to the levy have not changed under the Act. Under the Act, the levy does not apply in Biodiversity Conservation Strategy conservation areas.

What are the trigger events?

Unless an exclusion applies, a liability to pay the levy is triggered when certain "levy events" occur in relation to land in a levy area, being:

- the issuing of a statement of compliance for a plan of subdivision, or, in the case of a section 35 plan, certification of the plan;

- an application for a building permit;

- approval of a work plan or variation of a work plan under the Mineral Resources (Sustainable Development) Act 1990;

- construction of utility infrastructure on Crown land; and

- the construction of a road on Crown land.

The levy is imposed only once in respect of land in the levy area. A transfer of land which is the subject of a notice will not trigger, or otherwise affect, liability to pay the levy.

Who is liable to pay the levy and when?

Depending on the type of "levy event", the Act specifies the person who is liable to pay the levy and by when, with the payment process similar to that applying for payment of the GAIC.

Private land

In almost all cases on private land, it is the landowner who will be liable to pay the levy. This may be the developer of an estate, as issue of a statement of compliance will generally trigger the levy, or the landowner of a subdivided lot in the case of an application for a building permit (which will also generally trigger the levy). Upon payment, the Department of Environment, Land, Water and Planning (DELWP) will issue the appropriate certificate (usually a certificate of release or partial release), which must be produced to Land Use Victoria for lodgement of the plan of subdivision, or to the building surveyor, for issue of a building permit.

However, in the case of subdivision applications made under section 35 of the Subdivision Act 1988 where land is being vested in an acquiring authority for a public purpose such as a road reserve, there is no requirement for a statement of compliance to be issued. In this situation, with some very limited exceptions, the acquiring authority is liable to pay the levy. DELWP will issue a levy assessment notice directly to the acquiring authority, via email, following certification of the plan of subdivision.

Crown land

A person responsible for carrying out building work, a person to whom an approval is given under the Mineral Resources (Sustainable Development) Act 1990, a person carrying out utility infrastructure work or a person constructing a road or road infrastructure on Crown land within the levy area is liable to pay the levy.

In respect of the due dates for payment, the levy must be paid:

- within 3 months after the date a statement of compliance is issued under the Subdivision Act 1988 for plans of subdivision, however payment must be made to enable the plan to be lodged with the Registrar of Titles;

- within 3 months after the date a Section 35 plan of subdivision (for which a statement of compliance is not required) is certified under the Subdivision Act 1988;

- within 6 months after the date on which an application for a building permit (Crown and freehold land) is made, however payment must be made for the building permit to issue;

- within 3 months after the date on which approval is given to an extractive industry work plan (freehold land), or within 6 months after the date on which approval is given to an extractive industry work plan (Crown land), however payment must be made for the work authority to be granted; or

- within 6 months after the date on which construction work (utility infrastructure or roads) on Crown land is completed.

Once the levy amount is paid, DELWP will issue the appropriate certificate (usually a certificate of release) to confirm the levy has been paid, and which will enable the notice on title to be removed.

Excluded events

There are some activities that are excluded from payment of the levy, including:

- demolition of a building or part of a building;

- construction of a single dwelling;

- repair or reinstatement of an existing building;

- additions or alterations to an existing building that do not change or increase the floor area of the building;

- an application for a building permit solely in relation to the above categories of building work which are themselves excluded;

- telecommunications works constructed in accordance with a Facilities Installation Permit issued under the Telecommunications Act 1997 (Cth);

- an event to which an approval under Part 9 of the Environment Protection and Biodiversity Conservation Act (Cth) that is in force applies;

- a subdivision that solely realigns the common boundary between 2 lots, and the area of either lot is reduced by no more than 5% of its original area;

- a subdivision that solely creates a lot not exceeding 2 hectares to carve out an existing dwelling from the land;

- a subdivision along a levy area boundary to create 2 lots, one wholly within the levy area and the other outside the levy area; and

- a subdivision that excises land within the planning schemes of Hume, Melton, Mitchell, Whittlesea or Wyndham Councils subject to the Outer Metropolitan Ring/E6 Transport Corridor public acquisition overlay.

The Regulations under the Act may in due course prescribe additional excluded events.

What is the amount of the levy?

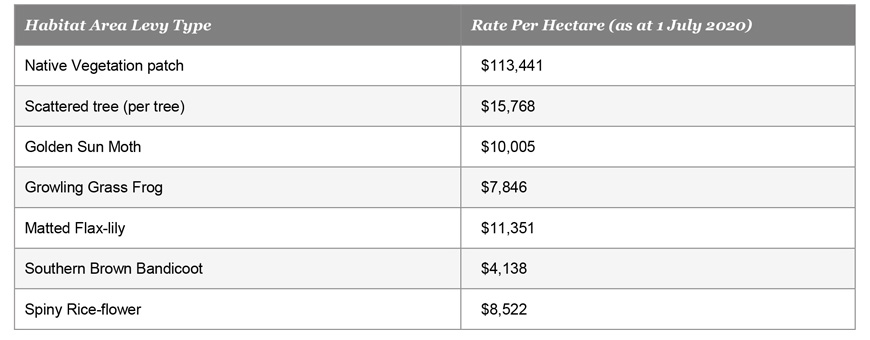

For the 2020/2021 financial year, the Act specifies the amount of the levy on a per hectare rate for the different "levy types". The following table sets out the levy types and rates, some or all of which may apply to any single parcel of land.

The Act requires the levy rate to be adjusted annually according to a tailored composite index (comprising of one third CPI and two thirds Wages Price Index).

Key takeaways

- The number of events that will trigger the requirement to pay a levy on freehold land have been minimised and made clearer for the development industry to understand when a levy event has occurred.

- While a notice will have been recorded on the certificate of title to land within the declared levy area, the levy does not become payable until a "trigger event" has occurred, and accordingly the levy cannot be paid in advance.

- The levy will need to be paid in order for a plan of subdivision to be accepted for registration by Land Use Victoria, or for a building surveyor to issue a building permit, thereby creating an effective compliance framework. However, once the levy is paid, there should be no impediment to settlement proceeding for the newly created allotments as provided for under the terms of a contract.

- As of 1 July 2020, infrastructure and utility providers are no longer required to pay a levy in relation to construction of infrastructure on freehold land. This is a significant change from the previous program.

- An online environment mitigation information system is available at https://nvim.delwp.vic.gov.au/bcs which will generate an estimate of a levy liability for a particular parcel of land under the Act, and identify whether the whole or part of a parcel is within a conservation area under the Biodiversity Conservation Strategy.