The Commonwealth Government launches Australia's Hydrogen Strategy 2024

The 2024 Hydrogen Strategy sets out the vision for hydrogen in Australia, which is for a “clean, innovative, safe and competitive hydrogen industry that benefits Australia’s communities and economy, enables our net zero transition, and positions us as a global hydrogen leader”.

On 13 September, Minister for Climate Change and Energy Chris Bowen launched the Australian Government’s 2024 National Hydrogen Strategy. The strategy aims to provide the framework to position Australia as a global hydrogen leader by 2030. The Government has indicated that it hopes the Strategy will be a “blueprint for Australia to develop new domestic clean energy manufacturing capabilities and capitalise on massive export opportunities for clean, secure energy supply chains through becoming a hydrogen world leader”.

Australia’s hydrogen opportunities

The Australian Government is extremely upbeat about the possibilities for the development of the hydrogen market for domestic uses and international trade. This position is well encapsulated in the market summary set out on the website of the Department of Climate Change, Energy, the Environment and Water, which is worth setting out in its entirety:

“Australia has an ambition to be a global hydrogen leader. Alongside renewable electricity, hydrogen will play a significant role in decarbonising our economy. It will support the export of hydrogen embodied locally manufactured products.

We can use hydrogen:

-

- as a source of heat or chemical for producing green metals

- as a fuel for hydrogen fuel cell electric vehicles, buses, trucks, planes and shipping

- as a source of energy storage and generation

- as a chemical feedstock to make zero carbon chemicals, such as clean ammonia methanol, and low carbon liquid fuels

- as a source of tradeable clean energy that other countries will need to decarbonise their own economies.

The global hydrogen market has been forecast to reach US$1.4 trillion in 2050. Australia has a range of comparative advantages in this market. These include vast renewable energy resources, space and land. These advantages allow us to competitively manufacture clean hydrogen and its derivative products for our own use, and to supply the world.

Australia has the largest pipeline of hydrogen projects of any country in the world. It has an estimated value over $225 billion. There are more green hydrogen projects under development in Australia than in any other country.

Hydrogen is central to the Australian Government’s vision for a Future Made in Australia. There is an opportunity to grow the Australian hydrogen industry sector. This will capture the significant economic, trade, export and investment opportunities that are becoming available.”

Review of the 2019 Hydrogen Strategy

The previous hydrogen strategy (2019) was subject to a formal review process, including public consultation, which closed in August 2013. While Australia’s initial strategy was among the first national hydrogen strategies announced globally, more than 30 countries followed suit, and investment in hydrogen development projects in other countries (reaching Final Investment Decision) started to outstrip the development of comparable projects in Australia.

In addition, as noted in the National Hydrogen Strategy review – Consultation Paper, notwithstanding Australia’s position as an early mover in the hydrogen sector and with considerable natural advantages, “the creation of new, extensive policy measures in other countries to support the development of their domestic hydrogen industries ... [including the] Inflation Reduction Act in the US … which provid[es] tradeable tax credits for hydrogen production that can be combined with tax credits for related renewable energy production and end use cases.” It further noted that a “number of large economies have responded with similar, albeit not quite as extensive, support mechanisms.”

The consultation process therefore posed the following questions:

- How can Australia enable decarbonisation through the development of a clean hydrogen industry?

- How could Australia further activate its hydrogen and related industries?

- How can we ensure our hydrogen industry attracts the necessary investment?

- How can we ensure our hydrogen industry develops in a way that benefits all Australians?

- How should we develop the necessary infrastructure needed to support the development of our hydrogen industry?

- How can we enable a hydrogen export industry (including the export of goods manufactured with hydrogen)?

The 2024 Hydrogen Strategy

The Strategy sets out the vision for hydrogen in Australia, which is for a “clean, innovative, safe and competitive hydrogen industry that benefits Australia’s communities and economy, enables our net zero transition, and positions us as a global hydrogen leader”.

The first four chapters of the Strategy outlines four objectives that focus new and ongoing Government policy decisions:

Key among the policy initiatives are the following, which are focused on Objective 1. Some are newly announced, and others are existing policy announcements or funding arrangements:

- A $2 per kilogram Hydrogen Production Tax Incentive, to provide a time-limited, demand-driven production support to eligible producers of renewable hydrogen through Australia’s tax system, forming the basis of government support to the sector, for up to 10 years, between 1 July 2027 and 30 June 2040.

- A $4 billion Hydrogen Headstart Program, to support large-scale renewable hydrogen production projects, to accelerate scaling of the industry and develop local development expertise.

- Investing over $500 million to support and co-fund the development of regional hydrogen hubs to co-host producers, users and potential exporters of hydrogen across industrial, transport, export and energy markets. Funding allocated to this initiative has already been announced for:

- the Pilbara and Kwinana in WA;

- the Hunter Valley in NSW;

- Bell Bay in Tasmania;

- Central Queensland and Townsville in Queensland; and

- Port Bonython in South Australia (which is already well under development).

- Concessional finance available via the Clean Energy Finance Corporation (CEFC), through its dedicated $300 million Advancing Hydrogen Fund, from which financing of more than $40 million has already been released.

- Grant funding administered via the Australian Renewable Energy Agency (ARENA) under several different arrangements:

- Commitments of over $300 million to R&D, feasibility studies and pilots including projects forming part of the 2024 Renewable Hydrogen Deployment Funding Round.

- The Australian portion of the German-Australian Hydrogen Innovation and Technology Incubator (HyGATE) initiative, under which each country has respectively committed up to AUD$50 million / €50 million. In January 2023, ARENA announced funding for four jointly funded projects under the HyGATE initiative.

- The already-announced $1.7 billion Future Made in Australia Innovation Fund, which will fund the deployment of innovative technologies and facilities linked directly to priority industries, including renewable hydrogen and hydrogen derivative industries (such as low carbon liquid fuels, low carbon metals such as green iron and green alumina).

In addition to these major policy initiatives, a focus on strengthened approvals processes, infrastructure planning and workforce development, skills and training round out the initiatives for Objective 1.

Objective 2 will focus on demand and sector prospects, including green metals (iron and alumina), ammonia, long-haul transport (road, aviation and shipping), power generation and grid support, all linked by the Government’s existing Safeguard Mechanism which incentives large industrials to decarbonise.

Objective 3 emphasises benefit sharing and availability with First Nations communities, regional jobs and businesses, together with the intention to plan for sustainable water use, the adoption of voluntary hydrogen industry codes of conduct for community engagement and partnerships to encourage best practice, and the promotion of best practices by the independent Australian Energy Infrastructure Commissioner.

Objective 4, building on existing bilateral and multilateral arrangements, aims to capture a share of international hydrogen markets through attracting investment and partnerships, developing a Guarantee of Origin scheme in line with international developments, and securing effective international supply chains to support project and market development. Australia already has bilateral clean energy or hydrogen arrangements with Japan, the Republic of Korea, the United States, Germany, Singapore, India, the United Kingdom, the Netherlands and Denmark. Australia is also a participant in several multilateral for a and organisations focussing on hydrogen, including the Mission Innovation Clean Hydrogen Mission, the Clean Energy Ministerial Hydrogen Initiative, the QUAD Clean Hydrogen Partnership, the Indo-Pacific Economic Framework Clean Economy Agreement and the International Partnership for Hydrogen and Fuel Cells in the Economy.

Cooperation between the Commonwealth and State Governments

A substantial part of the Strategy is dedicated to outlining existing and proposed future collaboration between Australian Governments. In addition to several detailed project and hub development summaries for all States and Territories, the Strategy identifies the following areas of ongoing focus:

- improvement of regulatory approval processes;

- best practice regulation with respect to safety;

- complementarity in funding and planning;

- a focus on the development of hubs and precincts;

- the delivery of training necessary to develop the hydrogen workforce;

- support for renewable energy development, including the Capacity Investment Scheme, and ongoing R&D and innovation;

- ensuring annual reporting through the State of Hydrogen report and undertaking 5-yearly reviews of progress against the Strategy itself, in light of sectoral decarbonisation plans; and

- an improved approach to “carbon leakage” arising from the current price premium attached to hydrogen where compared with current alternative, higher emission fuels.

Targets and actions

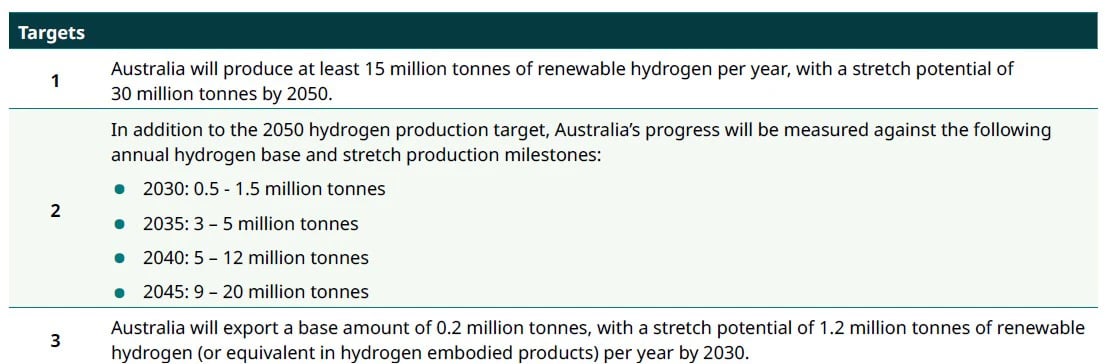

The Strategy summarises three major hydrogen production targets (as noted above) and 34 actions (in five categories, being the four Objectives plus a review and reporting category).

The full list of targets and actions is summarised in Appendix A of the Strategy, and these are given detailed treatment in Chapters 2 to 6.

In relation to Targets, the Strategy provides the following:

While all the proposed Actions are important, from a legal perspective regarding hydrogen development projects and the future of the hydrogen market, the following 10 actions are likely to be particularly noteworthy for potential investors:

- Action 1 – Focus government support on renewable hydrogen, complemented by suitable emissions intensity thresholds and other requirements for government-supported hydrogen projects, with GO certificates to form the basis of verification.

- Action 2 – Provide early policy support to enable the scaling up of the hydrogen industry to achieve production costs that are competitive with incumbent fossil fuels and to secure early offtake agreements.

- Action 3 – Consider reforms that may further enable specialist investment groups to play a bigger role in supporting the hydrogen industry to mature and secure further finance through traditional capital markets.

- Action 4 – Support the integration of hydrogen hubs into the broader scoping, planning and development by Australian governments of industrial precincts.

- Action 9 – Consider the readiness and prospects of ports to store and export hydrogen, import renewable energy components, and to provide safe marine refuelling using low-carbon liquid fuels such as hydrogen, ammonia and methanol.

- Action 20 – Support the inclusion of specific criteria in funding program guidance and obligations in funding agreements with Australian governments that require proponents to adopt best practice when engaging with First Nations communities including benefit sharing.

- Action 26 – To support infrastructure planning by companies and water planning agencies, future National Hydrogen Infrastructure Assessments will include a focus on water demand and availability for hydrogen production.

- Action 29 – Pursue opportunities to leverage investment from other countries who are willing to provide co-funding and make other efforts to build end-to-end global supply chains.

- Action 30 – Implement the Guarantee of Origin scheme in 2025, and progressively increase the scope of the scheme to support the expansion of the hydrogen industry.

- Action 31 – Existing partnerships will be prioritised as vehicles for furthering our international hydrogen objectives. Australia will look for opportunities to grow global markets and build end-to-end supply chains.

Where to from here? International investment markets and the GO scheme

Consistent with Actions 29 and 21, the 2024 Strategy has been released with translations into Korean and Japanese. In light of the existing bilateral agreements to which Australia is party, this gives a significant indication of the Government’s focus for development partnerships and investment into the Australian hydrogen sector.

Our next Insight article will summarise the GO bills noted above.

Get in touch