How property and real estate transactions will be impacted by the ACCC's new mandatory merger regime

From 1 January 2026, certain high value acquisitions of Australian real estate must be notified to the Australian Competition and Consumer Commission (ACCC) and cleared prior to completion, or substantial penalties will apply.

These requirements will apply in addition to Australia's foreign investment regime.

While there are exemptions for many residential and commercial property acquisitions, parties planning or negotiating acquisitions of Australian real estate should now consider the new regime as it will apply to transactions that complete on or after 1 January 2026. In particular, parties should consider:

which property transactions will need notification;

when the acquisition should be notified;

how long it will take to notify and wait for ACCC clearance;

which exemptions may apply; and

whether a notification waiver could be secured.

Which property transactions will be affected?

This article will focus on the acquisition of real estate assets. For more information on how the new mandatory merger regime will apply to other types of acquisitions, see our article.

Monetary notification thresholds

The monetary notification thresholds turn on the turnover of the parties as well as the value of the real estate acquired.

In calculating the Australian turnover in a real estate transaction, the relevant turnover of the purchaser includes the turnover of their wider corporate group and in the case of the target assets, will be the GST turnover of the vendor group attributable to that real estate and any other assets being acquired, not the total GST turnover of the vendor group.

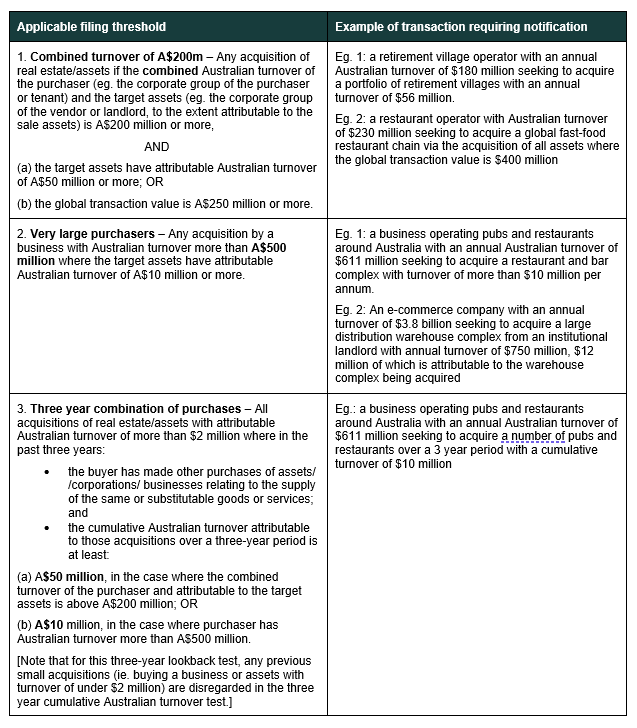

The notification thresholds proposed are summarised below, together with some possible examples of transactions likely to satisfy the applicable turnover test and require notification to the ACCC.

Major supermarkets are "designated" sectors

The draft regulations set out additional notification requirements for the acquisition of supermarket businesses by the major supermarkets (Coles, Woolworths and each of their connected entities), even if the above notification thresholds are not met.

This includes any acquisition of a legal or equitable interest in land provided that the land meets one of the following size requirements:

for land with a commercial building upon it, the gross lettable area of the building is greater than 700 square metres;

for land that does not have a commercial building upon it, the land is greater than 1,400 square metres.

Other sectors that have been flagged for possible future designation are fuel, liquor and oncology‑radiology.

What property transactions benefit from an exemption to notification?

Exceptions to the notification obligation

Certain land acquisitions will be exempt from the obligation to notify the ACCC, being land (vacant or developed land) acquired for any of the following purposes:

developing residential premises;

carrying on a business primarily engaged in buying, selling, or leasing land other than a purpose relating to operating a commercial business on the land, for example:

An institutional landlord seeking to acquire an office building for the purpose of carrying on the business of leasing the premises in the building, would be exempt. The acquisition of the lease for the premises by a tenant would not be exempt and would require notification if the relevant thresholds are met.

A property developer seeking to acquire vacant land for the purpose of constructing residential apartments for sale or lease, would be exempt.

Acquisitions of a legal or equitable interest in land where the acquisition is an extension or renewal of a lease for land upon which a commercial business is currently being operated, is also exempt from the obligation to notify.

Waiver process

Many property transactions will not raise competition concerns. Even if a property acquisition satisfies the monetary thresholds set out above, parties have the option of seeking a notification waiver from the ACCC to confirm that an acquisition is not required to be notified. Applications may only be made on or after 1 January 2026.

The ACCC has released guidance about waivers in its draft Merger Process Guidelines. The ACCC will update its guidance in the coming months to provide further detail about the information that should accompany waiver applications, reflecting the ACCC's intention that the waiver process be an efficient means of considering straightforward matters quickly (ie. within 20 business days of receiving a waiver application for the vast majority of cases) and with a low burden on business.

If my transaction doesn't meet the threshold, does that mean that I don't need to worry about the ACCC?

The ACCC will monitor acquisitions that have not been notified (eg. because the transaction falls below the thresholds or falls within an exception), and may take investigatory and enforcement actions if the ACCC considers that a transaction may have the likely effect of substantially lessening competition in any market in breach of section 50 of the Competition and Consumer Act 2010.

Having regard to the ACCC's assessments of acquisitions in this sector may give us an indication of the kinds of transactions that are likely to be scrutinised. In 2024, the ACCC considered but decided not to oppose Stockland and Supalai's proposed acquisition of 12 residential masterplanned communities (MPCs) from Lendlease Group, based on a court-enforceable undertaking from Stockland to divest its "Forest Reach" MPC Project in the Illawarra region. Without this undertaking, the ACCC considered that the proposed acquisition would likely have the effect of substantially lessening competition in the market for the supply of residential MPC housing in the Illawarra region because there was a "high concentration" in this market with Stockland and Lendlease competing closely as the two largest MPC developers with few alternative MPC developers in this particular region to constrain Stockland post-acquisition.

This ACCC has indicated that implementing Australia's new merger regime and rolling out the mandatory filing system will be a priority in 2025 and 2026. Therefore, if your transaction concerns land which is scarce or has particularly unique features (especially where you are operating in a concentrated market), but may not meet any of the mandatory merger filing thresholds, it would be prudent for you to seek competition advice about whether any competition concerns arise and what your options are for dealing with them.

Timeframes for property transactions in the new regime

The new regime consists of a 30-business day Phase 1 and a 90 business day Phase 2, with

scope for extension in limited circumstances:

Within Phase 1, a fast-track determination can be made as quickly as 15 business days after notification where the ACCC considers no competition concerns arise. Phase 1 may however extend to 30 business days.

If an acquisition progresses to Phase 2 (90 business days) because further analysis is required, the acquisition will undergo a more detailed ACCC assessment process to determine if the transaction should be stopped or can proceed.

The ACCC has indicated that it expects about 80% of acquisitions to be cleared via an early Phase 1 determination or the notification waiver process over a 15 to 20 business day period.

Key takeaways

If you operate in the property transactions market, you should:

consider all upcoming major transactions;

conduct preliminary checks on whether the turnover of the parties or their wider group would meet the turnover thresholds outlined above;

consider the anticipated timelines for major transactions;

think about additional questions that may be required during preliminary due diligence; and

seek competition advice on the applicability of the new regime to your transaction and, if so, the best way to navigate the ACCC filing process.

Get in touch