Don't risk re-notification: ACCC encourages merger parties to notify under new mandatory merger regime from 1 July 2025

The ACCC has foreshadowed in its transitional guidelines released today risks that proposed acquisitions may not be cleared if filed with the ACCC late this year, and encourages businesses to notify under the new merger regime under the transitional arrangements commencing from 1 July 2025. Parties to an acquisition that is not cleared or not opposed by the end of the year may need to re-notify, incurring additional time and costs and putting time sensitive transactions at risk.

The transition to the new merger clearance regime

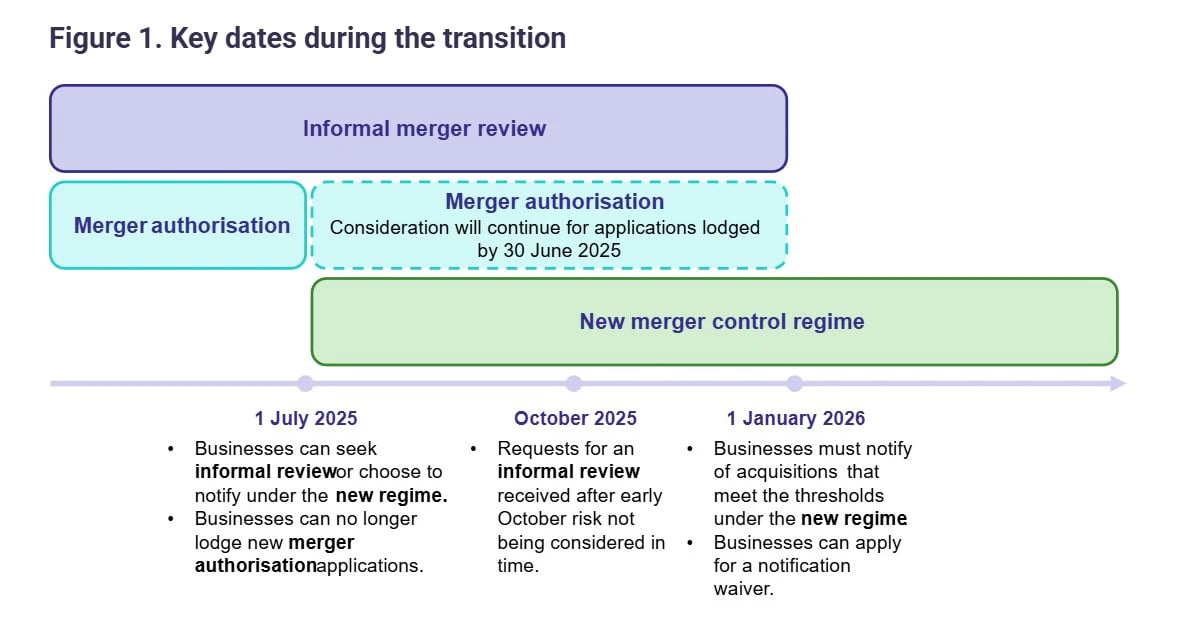

As the new regime will come into effect from 1 January 2026, the Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 introduces provisions to help businesses transition to the new regime, including the ability to notify under the new regime on a voluntary basis from 1 July 2025. This transition affects whether and how businesses approach the ACCC for clearance this year.

The transitional arrangements are to accommodate for the time it may take for the ACCC to assess an acquisition where the parties have sought informal clearance or authorisation. Parties to a proposed acquisition are encouraged to notify voluntarily the ACCC under the new regime to avoid having to re-notify if the review is not completed in time.

The important dates for your merger when considering to notify the ACCC

The key message is if an acquisition has not received clearance from the ACCC (or is not opposed) prior to 1 January 2026, the parties will need to re-notify the ACCC of the transaction (or possibly apply for a waiver) under the new regime if it is a notifiable acquisition that meets the statutory thresholds. The final thresholds have not yet been released, however see our summary of the Government's intended thresholds here.

The below timeline provides some key dates to consider:

Requesting an informal review of your merger

Parties should lodge any request for informal review as soon as possible. The ACCC will not continue the review if it has not been finalised by 31 December 2025 (they will be recorded on the ACCC's register as having "no decision").

The broad prohibition on acquisitions which have the purpose, effect or likely effect of substantially lessening competition in section 50 of the Competition and Consumer Act 2010 will continue to apply to deals that are not notified, even if the thresholds are not met. The ACCC therefore encourages parties to notify voluntarily under the new regime where there is uncertainty about whether the thresholds are met or the acquisition may raise material competition issues, to manage any potential legal action.

Requests for an informal review after 1 October 2025 may risk not being considered in time, even if there are limited or no competition risks. In this case, parties should consider voluntarily notifying under the new regime to avoid re-notification.

If the acquisition is pre-assessed or is not opposed by the ACCC between 1 July 2025 and 31 December 2025, there is no need to notify under the new regime so long as the parties have received a clearance letter from the ACCC and the acquisition is put into effect within 12 months of the date of the clearance letter.

If an acquisition has received clearance within this time frame but is not put into effect within 12 months of receiving such notification from the ACCC (and is a notifiable acquisition that meets the statutory thresholds), then the acquisition will need to be re-notified under the new regime.

If the ACCC has pre-assessed or indicated that it will not oppose the acquisition before 1 July 2025 but the transaction is not put into effect before 1 January 2026, it will be possible to request an updated informal view for the purpose of obtaining a contemporaneous letter that the ACCC does not intend to take action, provided the ACCC maintains their original view. Receiving this letter will mean the parties won't have to notify the acquisition under the new regime, as long as it is put into effect within 12 months of the date of the letter. The ACCC has advised that requests for an updated informal review should be made by early October 2025 to ensure it is completed by 1 January 2026.

Merger authorisation applications

The ACCC will not consider an application for merger authorisation after 30 June 2025. For earlier applications, if authorisation is granted before 31 December 2025, the acquisition will not need to be notified under the new regime. provided it is put into effect within 12 months of authorisation.

If the acquisition is not put into effect within 12 months, the parties will need to notify under the new regime or apply for a notification waiver.

If a merger authorisation application has not been finalised by 31 December 2025, the acquisition will be listed on the ACCC's public register as having "no decision". If the parties consider that there is a risk that the authorisation will not be finalised prior to the end of the year, the ACCC encourages the parties to voluntarily notify under the new regime.

ACCC on the lookout for anti-competitive acquisitions during transition period

The ACCC has also warned that it is aware that businesses might risk implementing anti-competitive acquisitions during the transition period without any, or minimal, notification to the ACCC and will use all available options to enforce and prevent such actions.

Getting your merger or acquisition across the line

With the prospect of re-notification when the new regime commences and the potential delays and costs that come with it, now is the time to consider whether any acquisition being considered this year may need to be notified and the best approach engaging with the ACCC. Expert legal advice on the effect of the new regime should be part of your plans, at least in the early days of the regime, and could be the difference between closing your deal and losing it.

Get in touch